As many assets in the cryptocurrency market start to resume their price increases, the sector’s largest altcoin – Ethereum (ETH) – has been one of them, and machine learning and artificial intelligence (AI) algorithms are fairly optimistic about its progress for the next several weeks.

Indeed, Ethereum has been riding the current bullish wave in the crypto sphere, heightened by the exceptionally positive prediction by investment giant VanEck, which sees the second largest asset in the cryptoverse by market capitalization, reaching a whopping $22,000 by 2030.

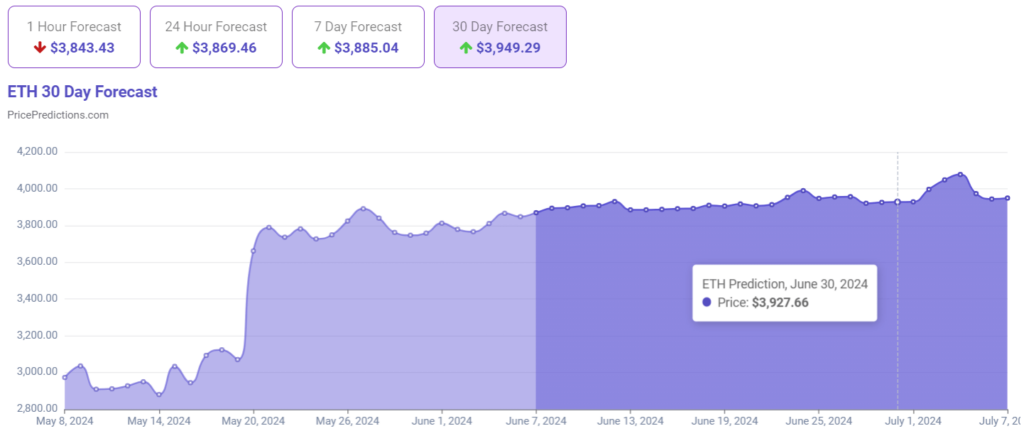

30-day Ethereum price prediction chart. Source: PricePredictions

Specifically, this would represent an increase of 2.12% from Ethereum’s price at press time provided that the prediction, which takes into consideration technical analysis (TA) indicators, such as relative strength index (RSI), Bollinger Bands (BB), moving average convergence divergence (MACD), and others, comes true.

Ethereum price analysis

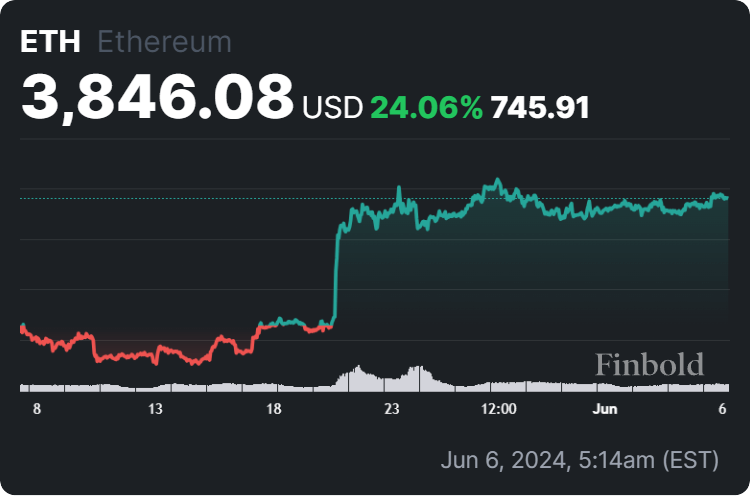

For now, Ethereum is changing hands at the price of $3,846.08, which represents a 1.42% gain in the last 24 hours, an increase of 2.83% across the previous seven days while adding up to the 24.06% advance accumulated over the past month, as per the latest charts on June 6.

Ethereum price 30-day chart. Source: Finbold

As a reminder, the $90 billion asset manager VanEck raised its 2030 ETH price target to $22,000, influenced by “ether ETF news, scaling progress, and our read of onchain data,” as well as the analysis of how ETH and Bitcoin (BTC) perform in both traditional and crypto-only portfolios for optimal returns.”

We've raised our 2030 ETH price target to $22K, influenced by ether ETF news, scaling progress, and our read of onchain data. Additionally, we've analyzed how ETH and BTC perform in both traditional and crypto-only portfolios for optimal returns. @Matthew_Sigel @Patrick_Bush_VE…

— VanEck (@vaneck_us) June 5, 2024In addition to the AI’s positive short-term prognosis, VanEck’s optimism suggests an overall positive sentiment regarding Ethereum’s future. However, it is important to keep in mind that trends in the crypto industry can sometimes shift, so doing one’s own research is critical when investing.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.