GameStop stock (NYSE: GME) is up 165% year-to-date, and the cryptocurrency market has navigated this hype with a GME memecoin. A Solana (SOL) DeFi trader has made $2.8 million in unrealized profits with this purely speculative meme token.

In particular, the account ‘7eTbufa‘ purchased the GME token on January 29 and April 3 while trading at low prices. Overall, the trader stacked 90.23 million GME in Solana year-to-date and patiently held despite months of low volume.

This strategy is paying off, as these holdings were worth $2.86 million when Lookonchain reported the achievement. Specifically, GME traded at $0.03120 on the decentralized exchange Raydium, while Solana currently trades at $171.

GME/SOL on Raydium, 4-hour chart. Source: Lookonchain

GME stock hype and a meme coin mania among Solana traders

Meme coins like Solana’s GME have been trending among cryptocurrencies since May 13. Renewed interest surged when the famous meme trader Keith Gill returned to social platforms. Gill, known as Roaring Kitty, inspired the GameStop stock short squeeze in 2021.

His appearance is visible on the chart above. Notably, there was a price surge at that time, followed by a crash once the influencer went silent. The Solana trader held his GME meme coin untouched during the pump and the following crash.

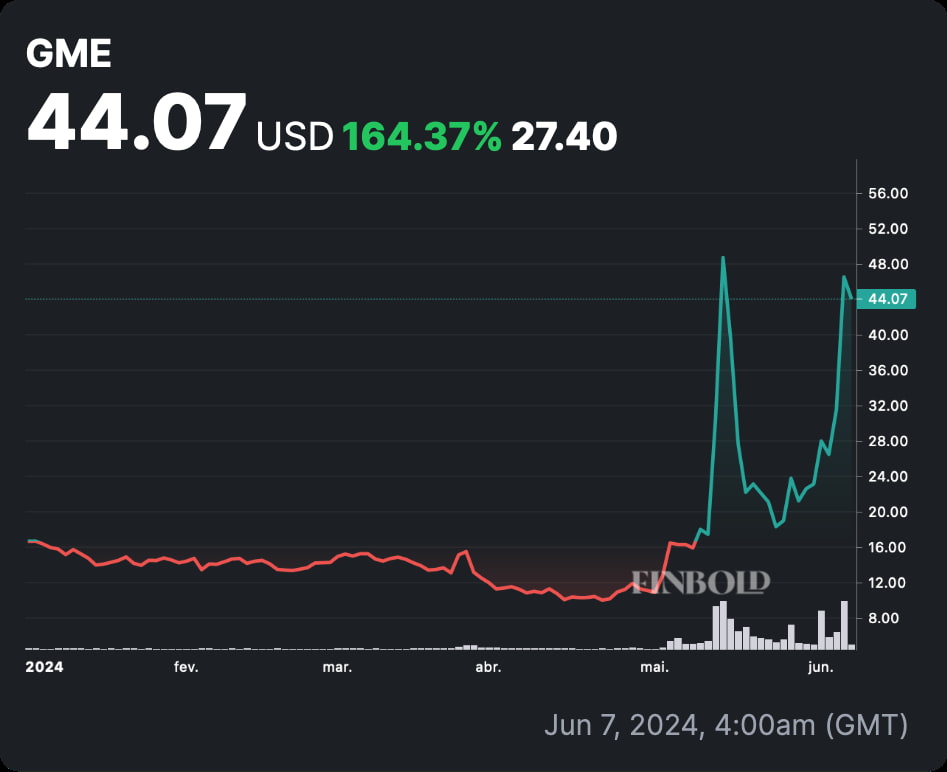

Nevertheless, Roaring Kitty’s Reddit account disclosed a $180 million position on GameStop on June 3, pumping these meme assets again. GME stock currently trades at $44.07, up 164.37% year-to-date.

GameStop (NYSE: GME) stock YTD price chart. Source: Finbold

In this context, it is worth the warning that trading meme coins or meme stocks can be extremely risky. The risk of ruin with this asset class is high, and most traders will lose money instead of accruing gains.

Furthermore, experts warn of “The Greater Fool” theory dynamics that resemble financial bubbles, when the “mania” disappears and the late buyers remain with massive losses of assets that have no organic demand besides the highly speculative nature of traders trying to outplay the market, but being outplayed as soon as the “music stops.”

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.