Speculation about a potential U.S. recession in 2024 has been rampant, with several indicators pointing to this possibility.

In such a scenario, various financial assets, including Bitcoin (BTC), will likely be affected, considering the asset has shown susceptibility to events in traditional finance.

Notably, Bitcoin has yet to be tested in a recessionary environment, so its performance will be closely watched. Therefore, Finbold consulted OpenAI’s latest artificial intelligence (AI) tool, ChatGPT-4o, for insights on how Bitcoin might trade during a recession.

Bitcoin price prediction. Source: ChatGPT-4o

Bitcoin untested during a recession

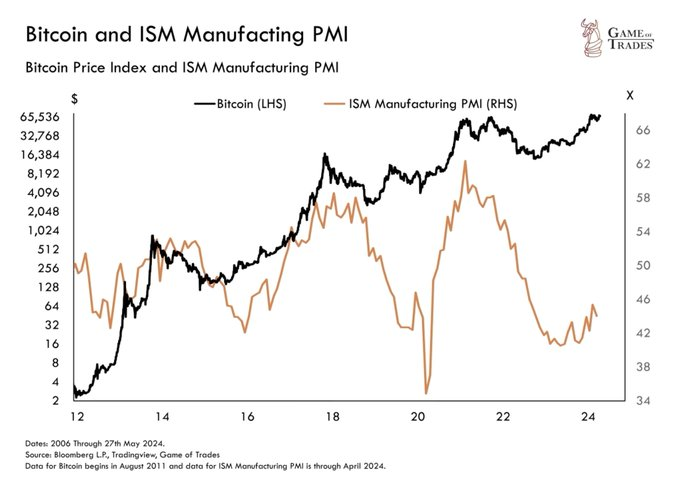

In line with Bitcoin’s possible reaction to a potential recession, investment research platform Game of Trades highlighted that Bitcoin remains heavily influenced by broader economic cycles, as evidenced by its close relationship with the ISM Manufacturing PMI.

In an X (formerly Twitter) post on June 7, the experts warned that a potential recession in the second half of 2024 could significantly impact Bitcoin’s price. This caution stems from the fact that Bitcoin has not yet been extensively tested in such an economic environment, leaving its future performance amid a recession uncertain.

Bitcoin and ISM manufacturing PMI chart. Source: Game of Trades

Bitcoin price analysis

By press time, Bitcoin was trading at $69,350 with daily losses of about 2.6%. On the weekly chart, Bitcoin is up 2.61%.

Bitcoin seven-day price chart. Source: Finbold

In the meantime, Bitcoin continues to consolidate below the $70,000 mark, and breaching this level will be central to helping the crypto target new highs.

Disclaimer:The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.