Over the last 24 hours, XRP has experienced one of its sharpest declines in recent months, breaching the crucial $0.50 support zone.

Maintaining a price above $0.50 was widely regarded as pivotal for the token to break free from the prolonged consolidation below $0.60.

Amid this bearish sentiment, cryptocurrency analyst Egrag Crypto, in a June 7 analysis posted on X (formerly Twitter), suggested that XRP is poised for what he termed as ‘legendary’ upside potential.

XRP price analysis chart. Source: TradingView/Egrag Crypto

Additionally, the analysis suggested that measured moves and Fibonacci targets signal inevitable double-digit gains for XRP. However, amid anticipating a significant uptrend, the analyst advised caution, urging investors to implement robust risk management strategies.

Intrigues behind XRP’s sharp decline

It’s worth noting that several factors are contributing to XRP’s current state amid the bullish prediction. Indeed, XRP’s current sharp decline has coincided with Ripple’s transfer of 200 million XRP tokens to an unknown wallet, sparking speculation about the token’s future.

Speculation regarding Ripple potentially abandoning its native token amidst plans to launch its stablecoin has also circulated.

Despite XRP’s lackluster performance and ongoing legal uncertainties with the Securities and Exchange Commission (SEC), Ripple has made notable strides in its business operations. For example, the recent partnership with Clear Junction aims to facilitate instant and secure GBP and EUR-denominated payouts for Ripple’s payment customers.

XRP price analysis

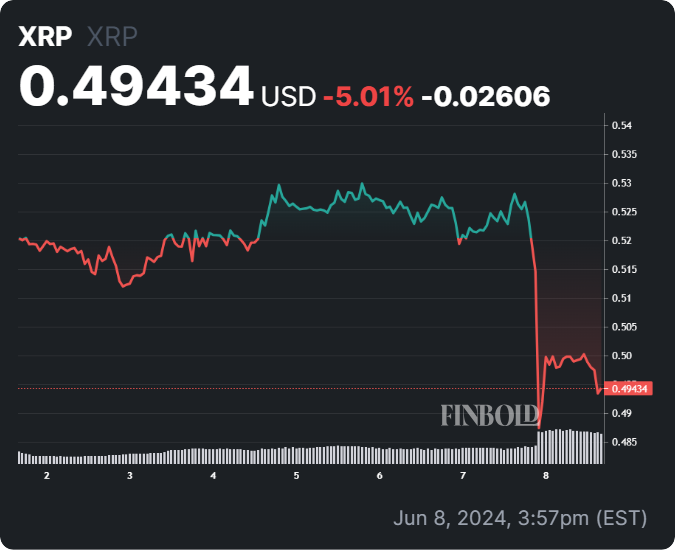

As of press time, XRP was trading at $0.49, having corrected by almost 7% in the last 24 hours and showing a 5% decline on the weekly chart.

XRP seven-day price chart. Source: Finbold

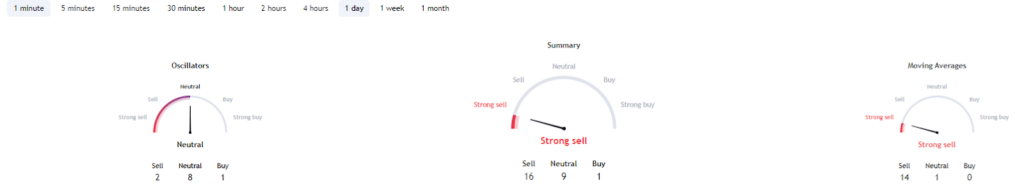

Elsewhere, the token’s technical indicators reflect the bearish sentiment surrounding XRP, with a ‘strong sell’ sentiment dominating the one-day gauges summary retrieved from TradingView and a similar sentiment under the moving average. Oscillators, however, present a ‘neutral’ stance.

Bitcoin technical analysis. Source: TradingView

In conclusion, if XRP emulates the 2017 move, the anticipated price movement could relieve investors concerned about the token’s failure to match up with established peers like Bitcoin (BTC) and Ethereum (ETH).

Disclaimer:The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.