Gaming cryptocurrencies became popular in the previous bull market through the innovative play-to-earn model that mixed investing with entertainment. However, most games were quickly developed and launched to join the hype, financially harming gamers and investors due to flaws and unsustainable economics.

In this context, Finbold looked to the current gaming cryptocurrencies and Web3 ecosystems with the highest development activity. This could give investors and gamers insights on solid projects building Web3 games for this cycle, competing among the best.

Public data gathered from Santiment shows the top five cryptocurrency projects that fit into the gaming category. In particular, MultiversX (EGLD) stands out with 235.47 activity in the last 30 days despite a 20.5% drop.

Top 5 cryptocurrencies by development activity (30 days), filtered by gaming. Source: Santiment / Finbold

MultiversX (EGLD) leads the gaming cryptocurrencies

Notably, the leading cryptocurrency by development activity in the gaming category has recently conquered this position that belonged to Decentraland. MultiversX, formerly Elrond, has gradually increased its presence among Web3 gamers and, especially, game developers throughout the year.

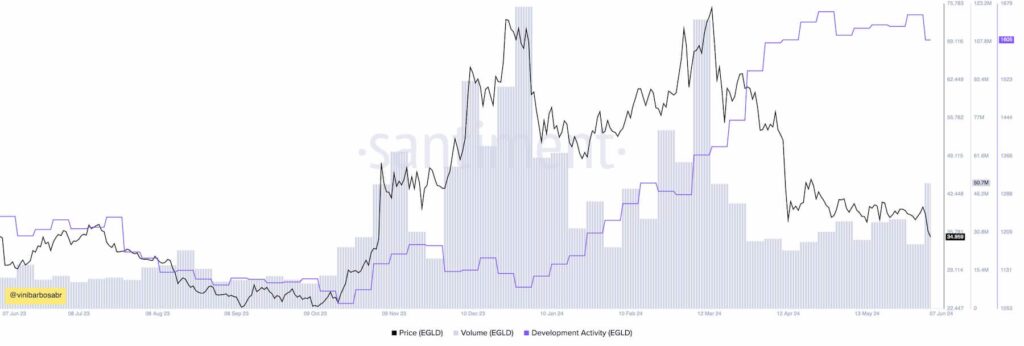

Looking at a year-over-year chart on Santiment, it is notable how the project’s development activity suddenly started surging in January. The 7-day indicator jumped from 1097 to 1605 by press time, increasing 46% year-to-date.

MultiversX (EGLD) developments activity (7 days) and volume. Source: Santiment / Finbold (Vini Barbosa)

Interestingly, MultiversX is a layer-1 blockchain competing with Ethereum (ETH), Solana (SOL), Cardano (ADA), and similar cryptocurrencies.

It stands out for its presence in gaming and is the only fully operational blockchain that has completely implemented the sharding technology for high scalability while keeping running nodes accessible with low CPU requirements.

Meanwhile, the network’s native token, EGLD, trades at 7-month lows, priced at $34.96. Nevertheless, a surging spot trading volume suggests the market interest could return to MultiversX, as suggested in the chart.

MultiversX total value locked in DeFi

From another perspective, MultiversX has managed to attract investors for its decentralized finance (DeFi) ecosystem. Essentially, the blockchain currently has $125 million in total value locked (TVL) among its protocols, ranking 39 against its competitors. Data is from DefiLlama, on June 8.

However, EGLD holds one of the best market cap-TVL ratios in the whole industry, considering a $952.5 million capitalization. The 7.54 MCap/TVL ratio suggests its token could be oversold in relation to the value its DeFi ecosystem currently has—offering a potential opportunity at these prices.

Top 37 to 41 chains by total value locked. Source: DefiLlama / Finbold

In closing, the gaming industry reached $184 billion in revenue last year, and forecasts expect it to reach $200 billion by 2024. Newzoo reported this data that highlights the 45% dominance of mobile games in 2023, for $90.5 billion.

Therefore, even a small share of this market could significantly increase the market demand for the $1 billion-capitalization MultiversX.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.