The cryptocurrency market experienced volatile trading last week, starting on a high note only to reverse course by week’s end. Initially, optimism surged as several analysts predicted Bitcoin (BTC) would reach new highs.

However, the release of robust U.S. job data on Friday altered the sentiment, hinting at a hawkish stance by the Federal Reserve.

Following the shift in sentiment, on June 11, the cryptocurrency market faced a sharp downturn, significantly impacting leveraged traders.

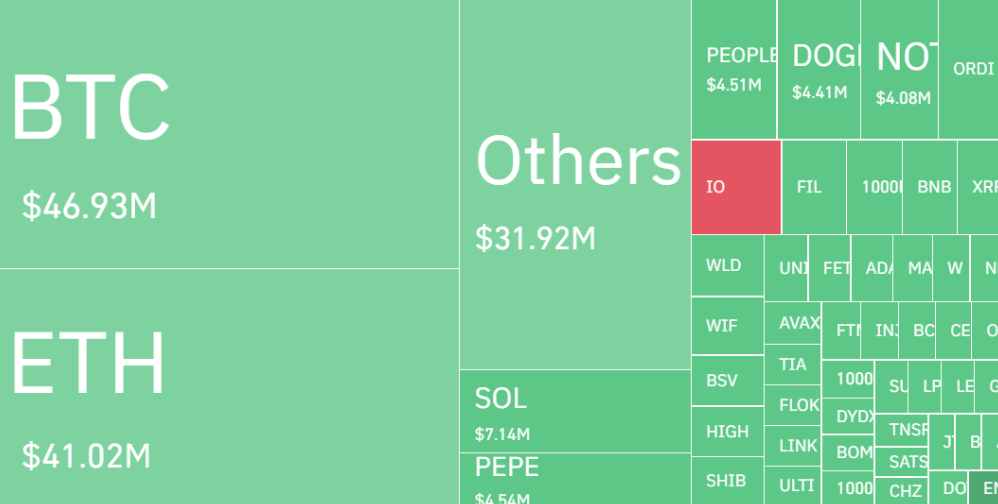

Liquidation data. Source: Coinglass

Liquidation data retrieved by Finbold from CoinGlass shows that, among the $190 million liquidated from 83,912 traders in the last 24 hours, the largest single liquidation order happened on OKX, with an ETH/USDT swap value of $5.21 million.

Bitcoin and Ether leveraged traders were the biggest losers, with $46.9 million in liquidations in the past 24 hours, of which $36.8 million were long positions and $14.07 million were short trades.

Ether traders registered the second-largest liquidation with $41.0 million, of which $31.3 million were longs and $9.68 million were shorts.

High open interest and increased volatility

Anticipating this volatile week, market analysts had already predicted significant impacts ahead of the FOMC meeting, known for historically influencing Bitcoin prices and increasing open interest. Notably,Bitcoin open interest reached an all-time high ahead of this meeting, as reported by Finbold.

High open interest in the cryptocurrency market often correlates with increased volatility.

Essentially, open interest (OI) measures the volume of long and short positions currently active and open. When open interest is high, it indicates a large number of active positions.

The higher the open interest, the higher the likelihood of aggressive moves as positions exert increased influence on the spot market.

In such a volatile market, sharp price movements can trigger a cascade of liquidations, particularly for highly leveraged positions. This is what transpired on June 11, as significant market movements led to substantial liquidations, compounding the downward pressure on prices.

Impact of CPI data on market sentiment

According to recent data by the U.S. Bureau of Labor Statistics, the U.S. CPI remains unchanged at 0.3% in May.

However, the market anticipated inflation to cool to 0.1% for the month. Despite the surge, on a yearly basis, CPI inflation cooled to 3.3% from 3.4% in May.

The cooling inflation data appears to have boosted market sentiment, especially after last week’s robust U.S. job data impacted the risk appetite of investors.

The cooling CPI data is particularly significant for the crypto market because lower inflation can ease concerns about the Federal Reserve raising interest rates.

This, in turn, can reduce the cost of borrowing and increase the amount of disposable income available for investment, thus encouraging more inflows into riskier assets like cryptocurrencies.

Consequently, investor behavior is positively influenced, as evidenced by the recent uptick in Bitcoin’s trading price. Currently, Bitcoin is trading at $69,195.81, showing a 3.3% increase on a 24-hour chart.

Given the recent market conditions, the upcoming FOMC data release is crucial for the crypto market’s next moves.

While the market correction has been severe, leading to significant liquidations, investors and traders should remain cautious and monitor these economic indicators closely.

The FOMC’s decisions on interest rates could further influence market volatility and investor behavior in the coming weeks.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.