In recent weeks, XRP has increasingly consolidated around the $0.5 mark as investors await a possible breakout.

Notably, amid the dormancy in XRP’s price, new on-chain data indicates that whale investors have been accumulating the token, possibly in anticipation of a rally. Particularly, addresses with at least 100 million coins have been buying more XRP tokens during the dip in the first ten days of June.

Adding weight to this observation is the Mean Dollar Invested Age (MDIA) metric, which provides further insight into investor behavior. As of June 1, the 90-day MDIA for XRP stood at 1,812, indicating investors prefer to hold onto their XRP holdings rather than engage in active trading.

XRP price analysis chart. Source: TradingView/Dark Defender

The stochastic oscillator is near the oversold region, suggesting potential for upward movement if historical patterns repeat. If the support line holds, a bounce back towards the upper trendline could occur, potentially aiming for the $0.70 to $1.00 range over the next few months.

Although XRP has failed to replicate the movement of assets such as Bitcoin (BTC), the cryptocurrency has several underlying fundamentals likely to spur a breakout. For instance, if the ongoing Ripple and Securities Exchange Commission (SEC) case is ruled in favor of the blockchain firm, it could act as a catalyst for XRP’s rally.

Additionally, Ripple’s continuous expansion of its network of partnerships with financial institutions worldwide brings much-needed credibility from institutional involvement. Indeed, the market also anticipates that XRP will likely rally once Ripple rolls out its stablecoin pegged to the US dollar.

XRP price analysis

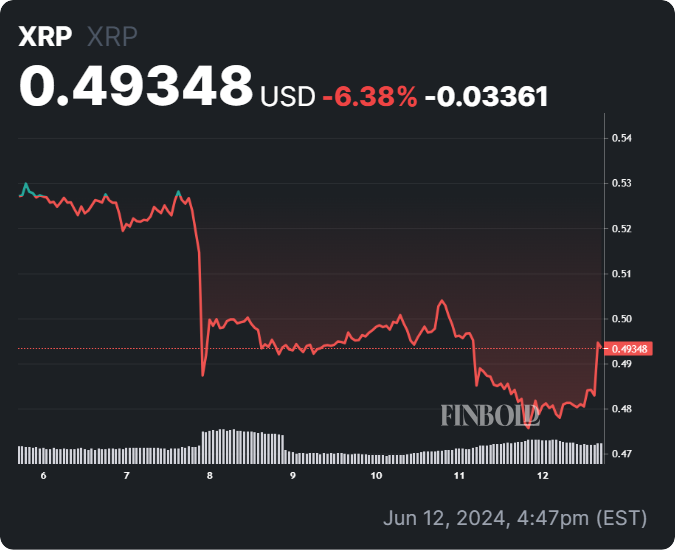

At the time of reporting, XRP was trading at $0.49, having rallied by over 2% in the last 24 hours. On the weekly timeframe, XRP was down 6%.

XRP seven-day price chart. Source: Finbold

In the short term, XRP appears to be consolidating between the $0.47 support and the $0.50 resistance. Notably, a breakout above $0.50 could signal a potential move towards the next resistance at $0.52. On the other hand, a breakdown below $0.47 could lead to further declines, with the next support levels likely around $0.45 or lower.

Disclaimer:The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.