Bitcoin (BTC) mining is a highly competitive and high-cost business activity directly reliant on the leading cryptocurrency price action. Miners can often see themselves operating underwater amid extended bearish or consolidation periods, forcing some to capitulate from mining.

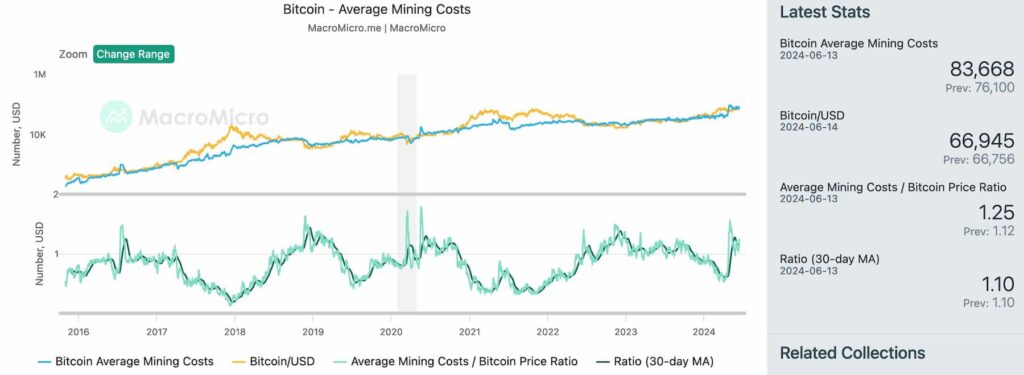

In particular, data retrieved from MacroMicro indicates this is happening right now, with an average cost of $83,668 per mined Bitcoin.

Bitcoin Average Mining Costs. Source: MacroMicro

Furthermore, two CryptoQuant researchers identified two signs of capitulation from Bitcoin miners this week, suggesting a non-favorable scenario.

Bitcoin supply held by miners. Source: Santiment / Finbold (Vini Barbosa)

Bitcoin mining benefits from economies of scale

According to multiple sources familiar with the matter, Bitcoin miners will operate underwater most of the time, and the activity is not profitable for medium and small players.

Interestingly, these entities often hedge their business with energy futures contracts or leverage themselves by borrowing or selling shares. Others will rely on side activities to remain relevant, like selling ASICs to miners or collecting mining pool fees. Moreover, these structures could generate heat for households or industries.

Most people don’t know, but Bitcoin mining isn’t a sustainable business model and most miners operate underwater most of the time.A miner usually does one (or all) of the four:1. Have free or low-cost energy;2. Hedge with energy futures contracts;3. Sits on massive leverage;… https://t.co/EliTNdbOpH

— Vini Barbosa (@vinibarbosabr) June 13, 2024These dynamics can highly favor economies of scale, where big miners get higher rewards from the network and become bigger. Meanwhile, small and medium players could be forced to capitulate from the activity by selling BTC reserves or mining infrastructure.

In the long run, these events could contribute to an increased centralization of a few big entities, as Finbold reported.