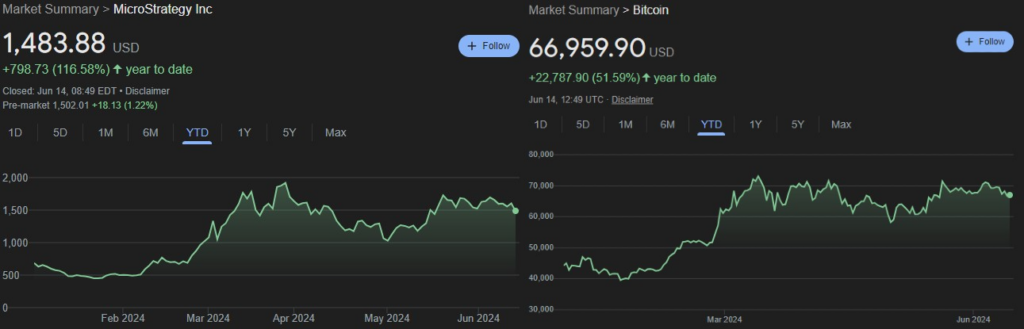

2024 was nothing short of impressive for MicroStrategy (NASDAQ: MSTR) as the largest institutional holder of Bitcoin (BTC) continued with its aggressive acquisition strategy of maiden crypto, as its subsequent rise in value by 51% in the first six months, more than doubled MSTR stock value.

Namely, as of June 14, MSTR stock has grown by 116.58% since January 1, as it continued to hoard Bitcoin and increase its holdings on every possible occasion.

Correlation between Bitcoin and MSTR’s stock price rise. Source: Google Finance

MicroStrategy will continue to buy Bitcoin

The next purchase is close, as MicroStrategy announced on June 13 that it plans to raise $500 million in debt to purchase more Bitcoin and other corporate purposes. The debt offering will consist of convertible senior notes due in 2032 and will be available to qualified institutional buyers (QIBs).

Picks for you

Can Bitcoin be stopped? Here's what ChatGPT-4 says 15 hours ago Here's when Solana could crash to $33, according to analyst 15 hours ago Bitcoin analyst warns of 'Bart Simpson' pattern and BTC price correction 16 hours ago Expert outlines phases of ‘the biggest crash’ for Bitcoin and altcoins as ‘trouble is approaching’ 17 hours agoInitial investors will have a 13-day option to acquire up to $75 million in notes. These unsecured senior notes will bear interest semiannually, starting December 15, 2024, until maturity, unless they are repurchased, redeemed, or converted earlier.

As of April 26, the company owned 214,400 Bitcoins, which, at today’s prices, would be valued at approximately $14 billion.

Any Bitcoin purchases in the second quarter would mark the 15th consecutive quarter of the company acquiring the cryptocurrency.

Wall Street sees benefit in MicroStrategy’s purchases of Bitcoin

Analysts from Wall Street love MicroStrategy’s aggressive stance regarding acquiring Bitcoin and see a direct connection between the rise in value of flagship cryptocurrency and MSTR stock price.

Analysts at Bernstein have initiated coverage on MicroStrategy with an “outperform” rating and a price target of $2,890, suggesting a potential 95% increase from its latest closing price.

Bernstein highlighted MicroStrategy’s transformation from a small software company to the largest holding company since August 2020. Now, it owns 1.1% of the world’s Bitcoin supply, valued at around $14.5 billion.

They noted that founder and chairman Michael Saylor has become synonymous with Bitcoin, positioning MicroStrategy as a leading company and attracting significant capital for its active acquisition strategy.

Analysts confident of MSTR stock climbing above $2,000

On May 28, Canaccord Genuity reaffirmed its “buy” rating on MicroStrategy stock and raised its price target from $1,590 to $2,047. This decision is based on MicroStrategy’s strategic approach to leveraging digital assets and the positive outlook for Bitcoin.

The analyst emphasized MicroStrategy’s role as a prime avenue for equity investors to gain exposure to digital assets, praising the company’s “intelligent leverage strategy.”

On April 5, BTIG raised its price target for MicroStrategy from $780 to $1,800 while maintaining a “buy” rating. This optimistic revision is driven by several factors, including a year-to-date surge in MicroStrategy’s stock and an increase in Bitcoin’s value, which is central to the company’s strategy.

Additionally, BTIG highlights the company’s accretive capital raises through equity and convertible debt offerings, which have increased the amount of Bitcoin per share for equity holders.

MSTR stock is poised to benefit from any further increases in Bitcoin’s value and is seen by analysts as an excellent exposure tool to these gains for retail investors who do not wish or can’t directly invest in BTC.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.