Ethereum (ETH) has once again captured the spotlight with its recent price movements and the emergence of a bullish pattern on its charts.

This pattern, often seen as a precursor to further price increases, has ignited discussions among investors and analysts about Ethereum’s potential to revisit previous highs.

Over the past week, Ethereum has experienced notable volatility, marked by a 7% decline in its price. The cryptocurrency’s performance in the previous month was characterized by a strong uptrend that significantly boosted its price.

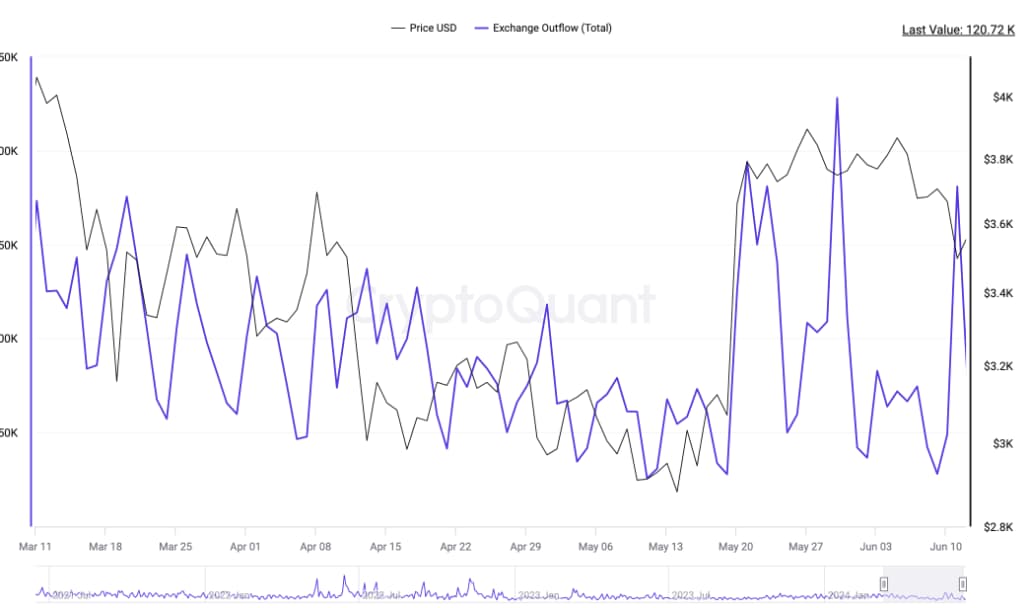

Ethereum outflow from centralized exchanges. Source: CryptoQuant

Analyst Ali Martinez noted increased whale activity, with large holders taking advantage of recent price dips to accumulate more Ether. On-chain data from Santiment shows the top 10 exchange wallets saw an 8.6% drop in ETH holdings as traders moved assets to private wallets

This high demand-side pressure, combined with reduced supply on exchanges, is likely to create a supply deficit that could push Ether’s price above $4,000 and into a parabolic uptrend.

Moreover, according to data, over 200,000 ETH options recently expired, and the crypto community eagerly awaits the direction of the Ethereum price.

14 June options delivery data 20,000 BTC options expired with a Put Call Ratio of 0.49, a maximum pain point of $68,500 and a notional value of $1.35 billion. 200,000 ETH options expired with a Put Call Ratio of 0.36, a max pain of $3,600 and a notional value of $710 million.… pic.twitter.com/42ruZLLtqc

— Greeks.live (@GreeksLive) June 14, 2024The majority of the expiring ETH options are call options, meaning buyers are betting the price will rise. At the same time, the put-call ratio is at 0.36, indicating that market participants are currently buying more call options than put options.

Market indicators and analysis

In addition to the outflow from centralized exchanges, fundamental and technical indicators offer insights into Ethereum’s current market dynamics and future potential.

A decline in Ethereum’s exchange reserves indicates a reduction in available supply, suggesting strong buying pressure from investors.

An increasing funding rate in the derivatives market shows that long-position traders are willing to pay premiums to hold their positions, typically favoring upward price movements.

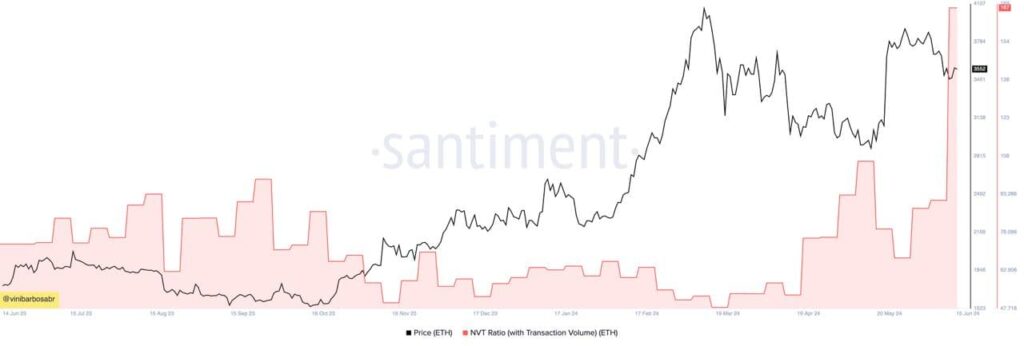

However, on-chain data from Santiment shows a high Ethereum Network Value to Transaction (NVT) ratio, which compares market capitalization to transaction volume, suggesting that Ethereum might be overvalued relative to its on-chain activity.

Ethereum NVT ratio. Source: Santiment / Finbold

This high NVT ratio implies that despite strong market interest and price performance, the on-chain transaction volume does not fully support Ethereum’s current valuation, indicating potential caution for investors.

Currently, Ethereum is trading at $3,562.24, with a 24-hour increase of 0.23%. Demand for Ethereum is spiking, signaling that traders expect the price to continue rising in the near term.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.