Bitcoin (BTC) miners have recently found themselves at the center of the crypto market due to the increasing selling pressure on their BTC holdings and the resulting impact on the asset’s price.

Notably, the selling activity has been considered a significant factor that derailed Bitcoin’s trajectory toward claiming the $70,000 resistance.

Looking ahead, data shared by crypto analyst Ali Martinez on June 15 suggests that miners still have a crucial role in dictating Bitcoin’s price and potentially spurring it to an all-time high.

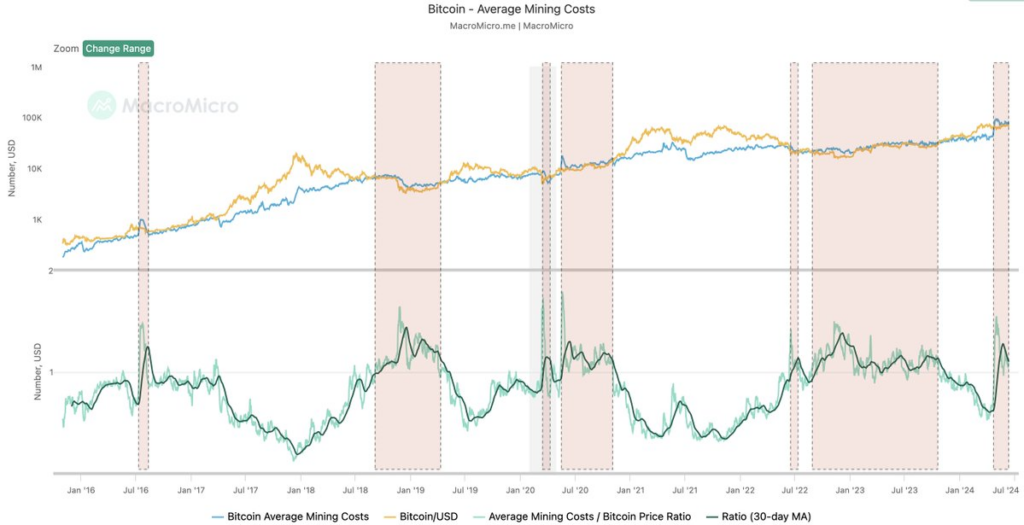

Bitcoin mining cost chart. Source: MacroMicro

Historical impact of mining cost on BTC price

The expert shared a chart sourced from MacroMicro, providing a detailed visualization of Bitcoin’s average mining costs, its market price, and the ratio between these two metrics over time. Notably, Bitcoin’s average mining costs and price have generally moved in tandem, with Bitcoin valuation often exceeding mining costs, particularly during bullish phases.

For instance, from mid-2016 to early 2018, Bitcoin’s price increased significantly above mining costs. Similar patterns are observable in the periods leading up to 2021 and mid-2023.

At the same time, the average mining costs to Bitcoin’s price ratio smoothed over a 30-day moving average (MA). They showed a cyclical pattern, with dips corresponding to periods when Bitcoin prices far outstrip mining costs. Historically, these dips have often preceded further price surges, reinforcing that mining costs are a critical support level for Bitcoin’s market price.

With Bitcoin’s average mining cost at $86,668, the current market scenario suggests that BTC must aim for this price level to cover mining expenses. The data aligns with the prevailing market consensus that Bitcoin is poised for further growth in the coming months, likely aligning with the post-halving bull run.

Indeed, if Bitcoin’s price aligns with mining costs, the cryptocurrency will rally 30% from its current valuation.

Impact of Bitcoin miners

Bitcoin investors are looking for possible triggers to help the asset exit the current consolidation phase. Notably, mining is emerging as a key catalyst to watch. As reported by Finbold, there were concerns about the growing selling activity by miners, as it signaled potential price capitulations.

In this context, Bitcoin briefly lost $67,000 in support, dropping to as low as $65,000. Meanwhile, Bitcoin was valued at $66,563 by press time, representing minimal gains of almost 0.5% on the daily chart.

Disclaimer:The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.