The cryptocurrency market has crashed, with most cryptocurrencies registering double-digit losses since June 17. In this scenario, crypto bulls lost nearly $400 million in long position liquidations, with over 165,000 traders getting ‘rekt.’

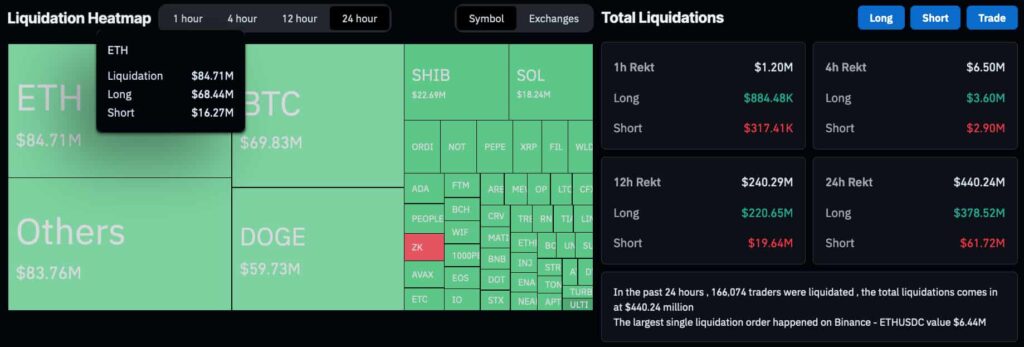

Finbold retrieved data from CoinGlass showing a total liquidation of $440.24 million in the last 24 hours. Notably, $378.52 million was from long positions that reached their liquidation prices, with a dominance of Ethereum (ETH). On the other hand, short-sellers lost less than $62 million.

Crypto bulls of the leading Web3 and DeFi blockchain lost $68.44 million, while Ethereum bears lost $16.27 million. Moreover, the largest single liquidation occurred with an ETH pair against the USDC on Binance, a $6.44 million order.

Liquidation Heatmap, 24 hours. Source: CoinGlass

Crypto bulls getting punished as volatility takes over to the downside

Overall, the market capitalization lost $136 billion from June 17 to the crash lows, as registered by TradingView‘s index. In particular, the Crypto Total Market Cap Index (TOTAL) dropped aggressively from $2.385 trillion to $2.249 trillion. It is currently at $2.293 trillion, slightly recovering from its worst moments today.

Crypto Total Market Cap Index (TOTAL), daily. Source: TradingView / Finbold

Interestingly, Finbold had been reporting bearish signs and indicators for the cryptocurrency market, especially for BTC and ETH. Bitcoin miners have capitulated aggressively with historical sell-offs, while Ethereum’s network value indicators hinted at an overvalued asset.

Analysts believe it is a good time to buy altcoins as crypto bulls got liquidated and de-leveraged their overall exposure. The TOTAL3 index, which refers to the capitalization of all cryptocurrencies, excluding Bitcoin and Ethereum, reached support at a $593 billion market cap, signaling a “once in a few years” opportunity.

#TOTAL3 Time to start buying #altcoins – just hit major support.Its now or never. The de-leveraging should be over now pic.twitter.com/iBnvKe8Eji

— CobraTrader (@Algorit_trading) June 18, 2024However, crypto traders—either bulls or bears—must act cautiously in the following days, considering the increased volatility, and avoid leveraged trades.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.