Bitcoin (BTC) has touched a one-month low as significant outflows from digital-asset investment products and concerns over prolonged high US borrowing costs impacted the cryptocurrency market.

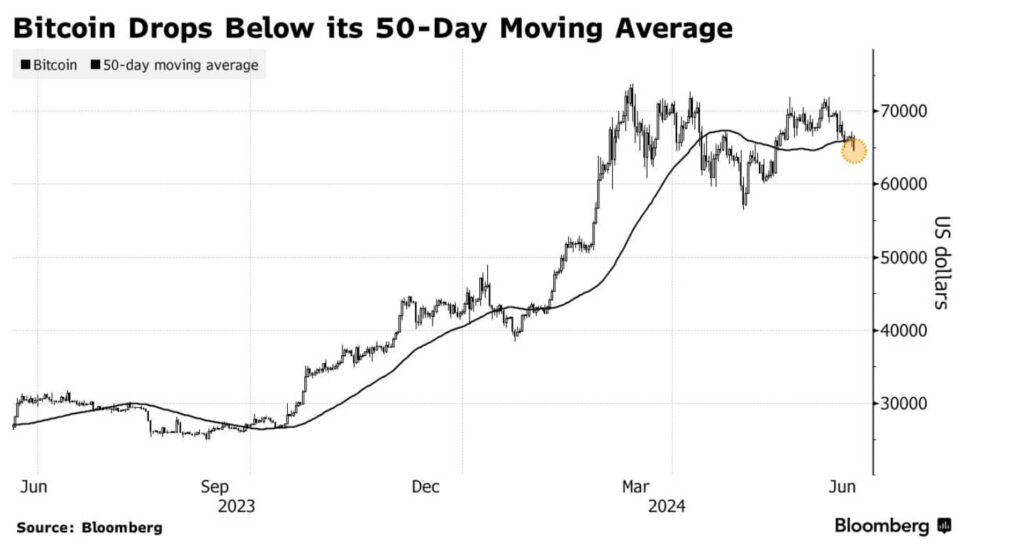

The largest digital asset dropped by as much as 2.7% on June 18, reaching a level last seen in mid-May, before recovering slightly to trade at $65,266. This decline saw Bitcoin drop to a crucial support level of the 50-day moving average, indicating a short-term downtrend in the crypto market.

Bitcoin drops below its 50-day moving average. Source: Bloomberg

In the second quarter, traditional asset classes like stocks and bonds have delivered better returns than Bitcoin, which has dropped about 5%. According to Bloomberg, global equities, fixed income, and commodities have all outperformed Bitcoin, highlighting a potential slowdown in the cryptocurrency market.

BTC 7-day price chart. Source: Finbold

At the press time, BTC is trading at $64,636, marking a 1% decrease on the daily chart and a 3% drop on the monthly chart, with its market cap dipping just below $1.3 trillion.

Traders and investors are closely watching these movements with cautious optimism for future recovery. Despite the current downturn, the market’s cyclical nature suggests that opportunities abound for those willing to navigate the volatility.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.