The cryptocurrency market has experienced a recent price crash, with altcoins suffering the most and registering double-digit losses. Nevertheless, prominent crypto analysts believe this asset class presents a “once in a few years” opportunity, forecasting a positive outcome.

This is because some cryptocurrencies could be undervalued in the current market while offering remarkable solutions despite the speculative volatility.

Essentially, using capitalization as a benchmark can provide valuable insights into fundamental analyses and promising altcoins with notable competitive advantages. The market cap is a better-suited metric for that goal than the cryptocurrency’s individual price, considering supply can vary drastically.

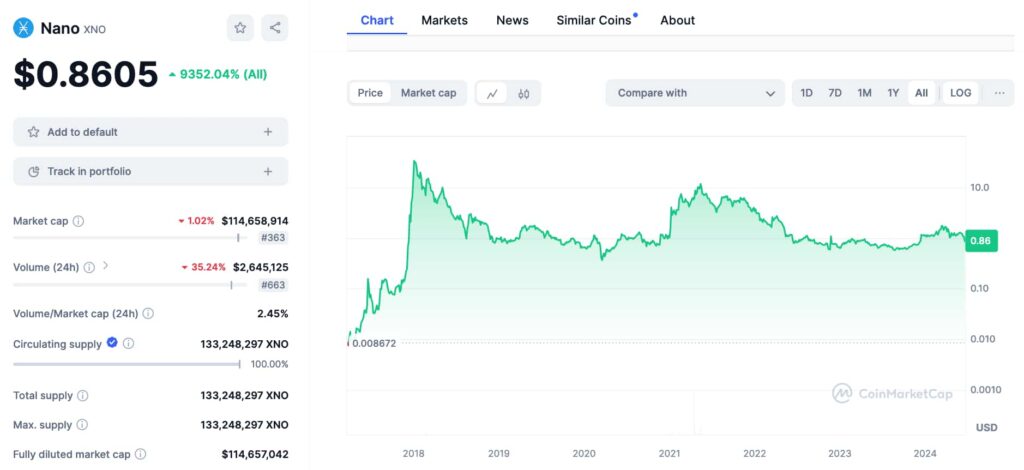

Nano (XNO) market cap and price data. Source: CoinMarketCap

Nano (XNO) fundamentals for a $1 billion market cap

Despite the low capitalization, Nano has solid fundamentals and competitive advantages following Bitcoin’s (BTC) vision of a peer-to-peer electronic cash system, as designed by Satoshi Nakamoto.

The coin’s distribution ended in late 2017, with a non-inflationary supply for the past seven years. As of this writing, the Nano network is the cheapest and fastest way of making peer-to-peer transactions. This is possible because the protocol does not charge fees from its users and settles transactions within 0.5 seconds.

Interestingly, the network recently reached a new milestone, confirming over 200 million blocks of XNO transactions. One popular use case for the digital currency is paying per-use AI tools like ChatGPT, Dall-E 3, and Claude 3 Opus.

The #Nano network just crossed the 200 million block milestone ? Every single one of these blocks was processed without fees.A lot of development has happened on the network in recent years, most notably in anti-spam resistance, making the network more durable for the next 100… pic.twitter.com/zn0qr9vFyS

— Nano Seagull Ӿ (@nanoseagull) June 16, 2024Nano development activity and number of nodes

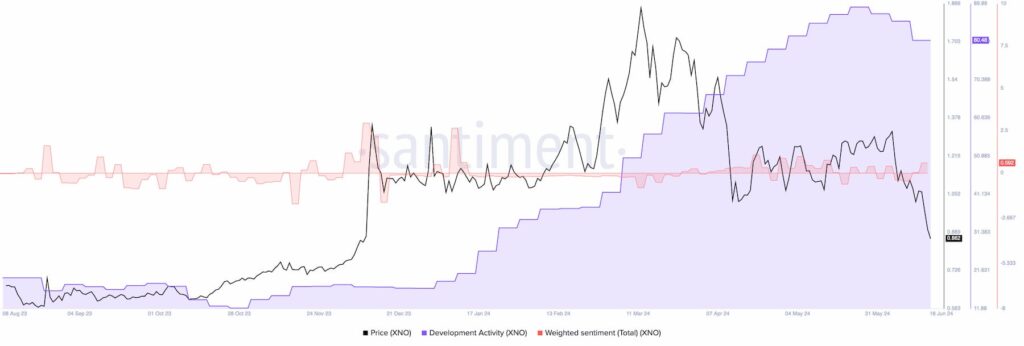

The protocol continues to be actively developed by volunteer open-source contributors, with two node implementations currently increasing code decentralization. Finbold retrieved data from Santiment on June 19, monitoring the development activity from the main implementation, which scored 80.48 in a week.

Notably, the development activity exceeds many other cryptocurrencies with a higher market cap. In perspective, it scored 0.70 development activity points for each $1 million capitalization.

Nano (XNO) development activity and weighted sentiment. Source: Santiment / Finbold

Similarly, the Nano network has one of the highest connected nodes count weighted by its capitalization, with 1.44 nodes per $1 million of market cap. Finbold gathered the node count from the blocklattice.io node monitor, registering 165 peers.

In comparison, Bitcoin currently scores 560 of its weekly development activity with 56,746 estimated nodes by bitnodes.io. This would result in 0.0004 and 0.044 activity and node count per each $1 million capitalization, respectively. BTC currently has a $1.28 trillion market cap, trading at $65,000 per coin.

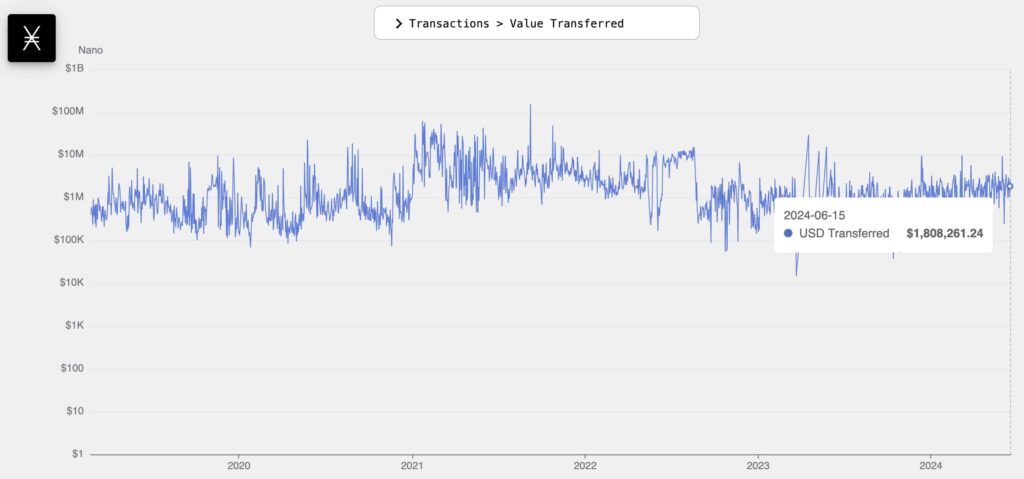

Transaction volume as a fundamental metric

Furthermore, nano has a proportionally high on-chain transaction volume, weighted by its market value. The last available data from the nano.community ledger explorer shows $1.80 million sent on June 15. This represents an NVT ratio of 63, calculated by dividing the $114 million market cap by the daily transaction volume.

Nano (XNO) Transactions – Value Transferred. Source: nano.community

Santiment uses this metric for fundamental analysis, similar to the stock market’s Price-to-Earnings (P/E) ratio. Finbold previously reported Ethereum (ETH) having an all-time high NVT Ratio, suggesting an overvalued asset.

Currently, BTC and ETH display an NVT ratio of 258 and 154, indicating a massively higher capitalization in comparison to the total volume transacted on their networks. On June 15, the Bitcoin and Ethereum networks confirmed $5.06 billion and $3.22 billion in transactions, respectively.

Bitcoin (BTC) and Ethereum (ETH) NVT ratio and transaction volume in USD. Source: Santiment / Finbold

Can XNO reach a $1 billion market cap?

Therefore, these metrics suggest that Nano could be undervalued because of its fundamental value to the cryptocurrency landscape. However, having good fundamentals and being undervalued does not guarantee that XNO will be able to attract enough demand and capital.

Many cryptocurrencies have gone from zero to above $1 billion in capitalization in a matter of days without solid fundamentals. For example, the meme coin PEPE has a nearly $5 billion market cap as of this writing and reached the one-billion mark a few days after launch.

On the other hand, these accomplishments demonstrate that it is possible for Nano to reach the $1 billion mark with sufficient momentum. For that, the cryptocurrency market must start looking at core fundamentals and utility and recognize this value on XNO.

A run to a $1 billion market cap would put XNO at $7.50 per coin. Nevertheless, investors must be cautious and understand the inherent risks of low-cap cryptocurrencies like Nano, which can have increased volatility, and hedge their positions accordingly.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.