As Bitcoin (BTC) continues to range in a more-or-less uninteresting trend, well below its previously attained all-time high (ATH) of $73,738 from March 14 this year, machine learning and artificial intelligence (AI) algorithms are pessimistic regarding its price performance in the near future.

Indeed, Bitcoin’s price action has slowed down in the past several weeks, dropping to the area around $65,000 and consolidating there, only recently returning above the $66,000 mark and providing a trigger for the rest of the market to record modest gains.

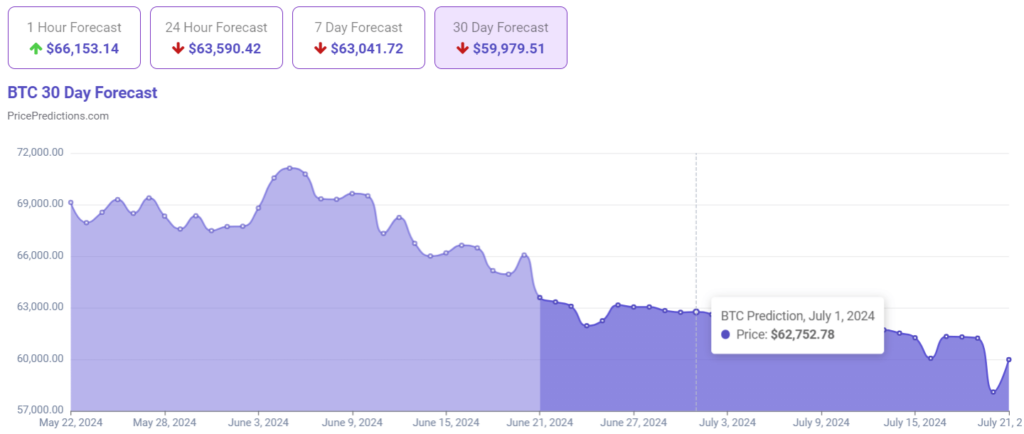

Bitcoin price 30-day forecast. Source: PricePredictions

In other words, the maiden crypto asset could drop by another 5.21% from its current price if the algorithm, which utilizes technical analysis (TA) parameters like relative strength index (RSI), moving average convergence divergence (MACD), Bollinger Bands (BB), average true range (ATR), and others, is correct.

Bitcoin price analysis

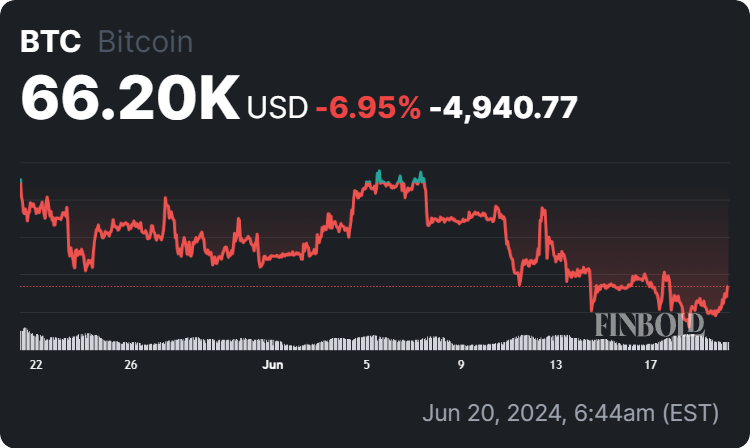

For the time being, the flagship decentralized finance (DeFi) asset is changing hands at the price of $66,200, recording a 1.26% gain in the last 24 hours while dropping 2.27% across the previous seven days and adding up to the 6.95% decline over the past month but still advancing 53.91% since the year’s turn.

Bitcoin price 30-day chart. Source: Finbold

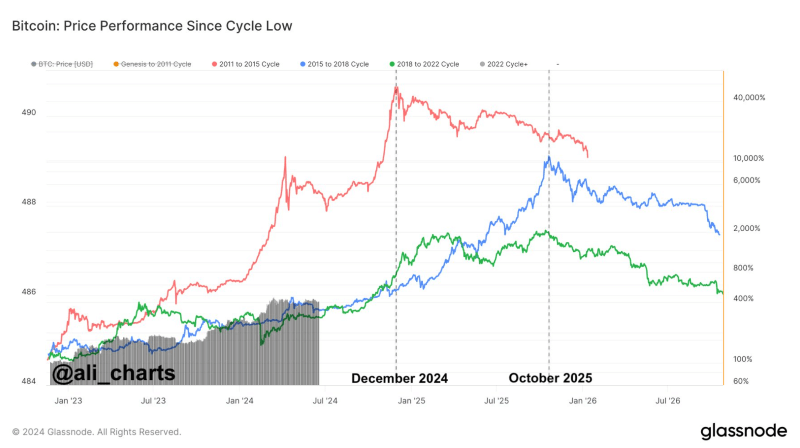

Meanwhile, professional crypto trader Ali Martinez has observed that if Bitcoin’s current market cycle mirrors the previous three ones, the cycle “top could actually come around December 2024 or October 2025,” depending on which of these paths it follows, as Finbold reported on June 19.

Bitcoin price performance since cycle low. Source: Ali Martinez

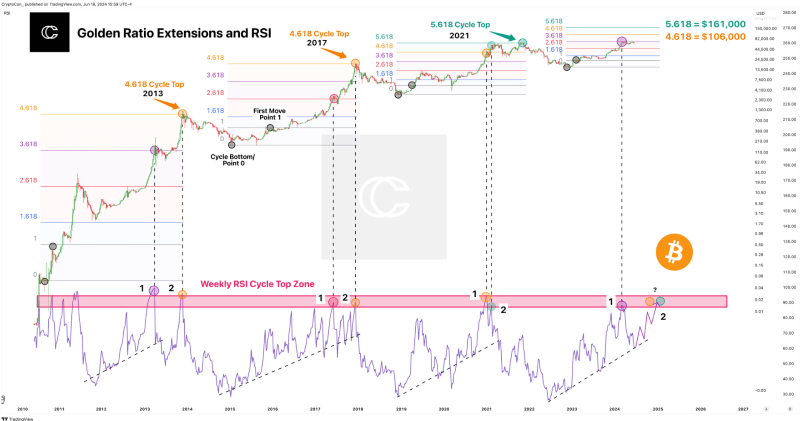

At the same time, pseudonymous crypto market analyst CryptoCon has shared two scenarios for the price of Bitcoin at the cycle top using a Fibonacci retrace from the cycle bottom to the top of the first move, suggesting $106,000 or a less conservative $161,000, as per an X post on June 19.

Bitcoin golden ratio extensions and RSI. Source: CryptoCon

All things considered, Bitcoin might, indeed, start the next month at a lower price than at the moment, but crypto experts suggest that the decline is only temporary and a natural part of its cycle, and that the cycle top for the largest asset in the crypto sector by market capitalization will arrive as scheduled.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.