Ethereum (ETH) is witnessing increased activity both on its network and from the legal front. Amid these developments, attention is being paid to the valuation of Ethereum as the decentralized finance (DeFi) asset continues to battle key resistance levels.

In recent developments, the network has experienced a surge in active addresses, according to data provided by crypto analyst Ali Martinez in an X post on June 22.

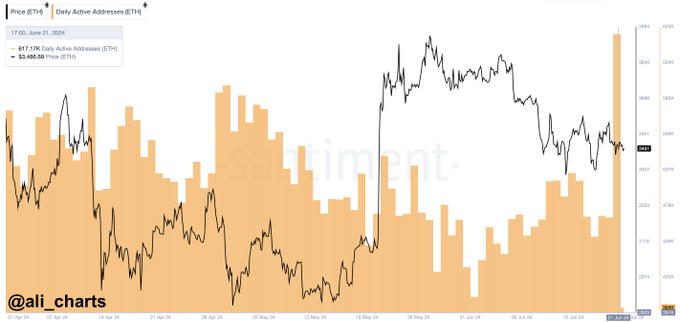

The data shows that Ethereum saw its largest spike in active ETH addresses in the past three months, reaching 617,170. This uptick in activity suggests increasing interest and engagement with the Ethereum blockchain, which could affect its price trajectory.

Ethereum active daily addresses chart. Source: Santiment/ali_charts

The increase in active addresses could be interpreted as a sign of growing network usage and confidence in the platform. Historically, such spikes in active addresses have often preceded price rallies, as increased activity can indicate higher transaction volumes and more utility.

In addition to the increase in active addresses, Ethereum is also witnessing a rise in other metrics. According to data provided by crypto analytics platform CryptoQuant, Ethereum’s Market Value to Realized Value (MVRV) indicator is rising faster than Bitcoin’s (BTC) MVRV.

MVRV is the ratio of a digital asset’s market capitalization relative to its realized capitalization. It is used to assess whether the token is undervalued or overvalued.

Ethereum price prediction

The spike in user activity coincides with a period when Ethereum is largely subdued, aligning with overall crypto market sentiments. In this line, CoinCodex, a platform utilizing AI-driven machine learning algorithms, has offered Ethereum’s price prediction in the short term.

According to data retrieved from the platform on June 23, ETH will likely trade at $3,552 by July 1, 2024. The forecast reflects a modest price gain of 1.6%.

Ethereum price prediction. Source: CoinCodex

Ethereum remains in focus after the Securities and Exchange Commission (SEC) moved to close its “Ethereum 2.0” investigation of ConsenSys. According to ConsenSys, the SEC’s enforcement division notified the blockchain company that it was closing its investigation into Ethereum 2.0. The SEC noted that it “would not bring charges alleging that sales of ETH are securities transactions.”

Ethereum price analysis

As of press time, Ethereum was valued at $3,497, having recorded minimal gains of about 0.05% in the last 24 hours. On the weekly chart, Ethereum is down 2.5%.

Ethereum seven-day price chart. Source: Finbold

Overall, over the past seven days, Ethereum has faced significant downward pressure, influenced by regulatory news. The key support level to watch is around $3,495, with major resistance at $3,550. If Ethereum can maintain above $3,495, it might attempt to break through $3,550; failure to hold $3,495 could lead to further declines.

Disclaimer:The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.