Considering that trends in the cryptocurrency market often change, it can sometimes be difficult to gauge the right timing for buying assets like Bitcoin (BTC). However, there is one indicator that can help make this task easier, as observed by a renowned crypto trading expert.

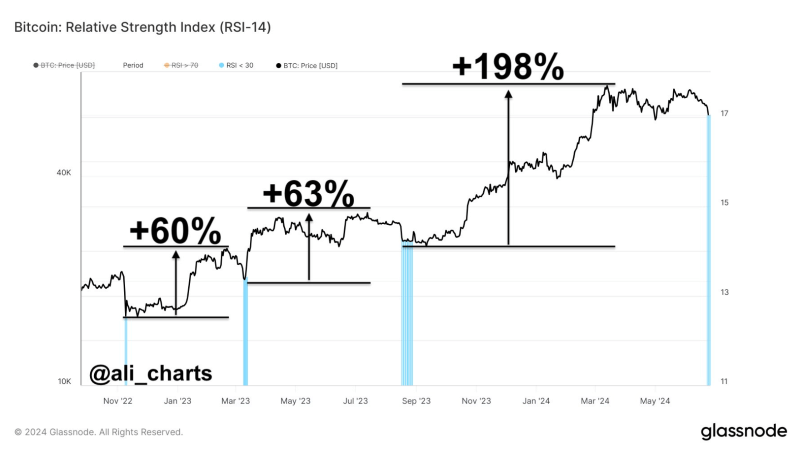

Specifically, popular crypto market analyst Ali Martinez pointed out that the relative strength index (RSI), using 14 periods, had always signaled the perfect time to buy the Bitcoin dip, as it does at the moment, according to the analysis he shared in an X post on June 25.

Bitcoin RSI indicator chart analysis. Source: Ali Martinez

As per the above chart, a reading of 30 or below points to an undervalued situation and is the ideal time to buy the Bitcoin dip before it sets off on its upward course, or as Raoul Pal dubbed it (and Robert Kiyosaki agreed with), lifts off into the ‘Banana Zone.’

BTC Fear and Greed index concurs

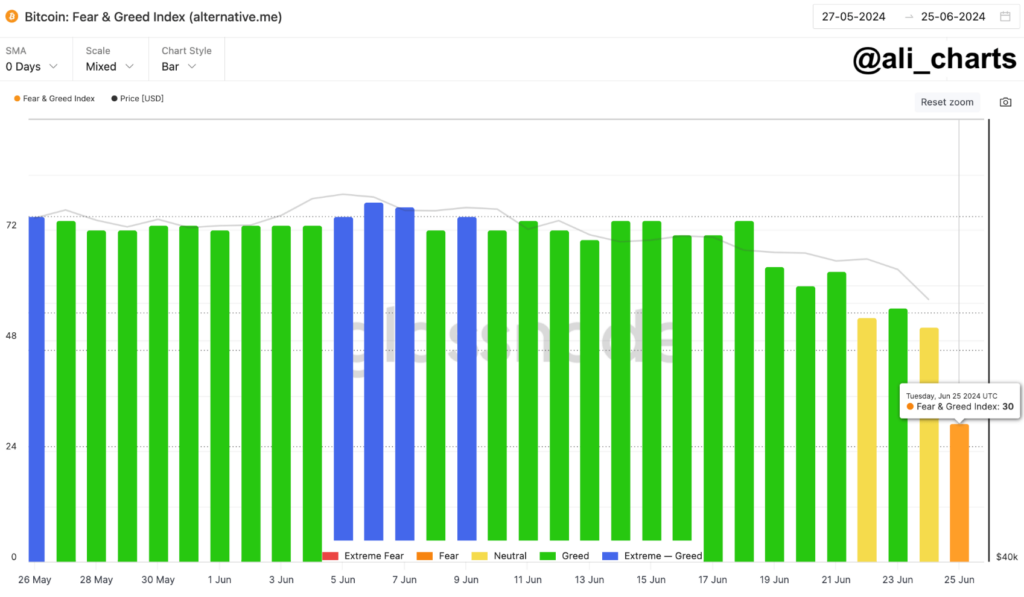

Previously, Martinez also highlighted that the BTC Fear and Greed index had turned into fear on June 25, advising his followers to “be greedy when others are fearful,” in other words, suggesting that they buy the flagship decentralized finance (DeFi) asset at a time when others are avoiding it.

BTC Fear and Greed Index. Source: Ali Martinez

In particular, the BTC Fear and Greed index has dropped to 30 points, which suggests ‘fear’ from the earlier ‘neutral’ sentiment on June 24 and ‘greed’ on June 23, although it is yet to hit the ‘extreme fear’ zone, which would represent an even better opportunity to accumulate Bitcoin.

Bitcoin price analysis

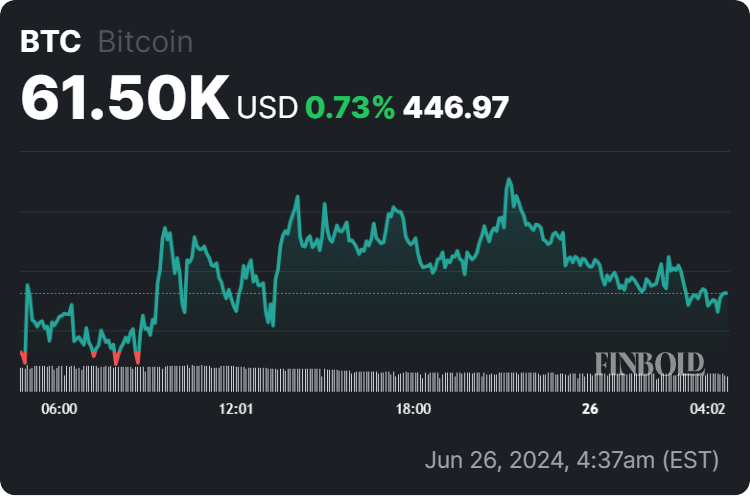

At press time, the largest asset in the crypto sector was trading at the price of $61,500, which represents a modest gain of 0.73% in the last 24 hours, as it tries to reverse the loss of 5.80% from across the previous seven days, and the accumulated decline of 10.53% from its monthly chart, as per data on June 26.

Bitcoin price 24-hour chart. Source: Finbold

All things considered, Ali Martinez is a seasoned participant in the crypto sphere and his Bitcoin analyses and corrections have often proved correct. That said, the influences in this sector do not always play by the book, so doing one’s own research and understanding the risks is critical when investing.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.