Bitcoin (BTC) has experienced a sharp drop, triggering “buy the dip” chants over the crowd, as retail’s sentiment remains bullish. On Binance, three in every four traders have open long positions in the leading cryptocurrency, threatening a short-term long squeeze.

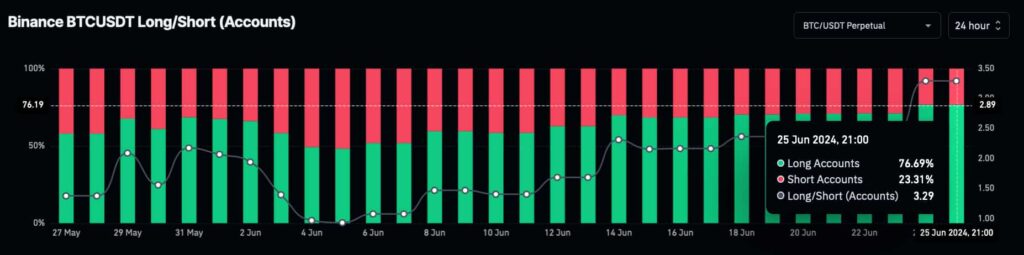

Finbold retrieved Binance’s 24-hour long/short ratio data from CoinGlass, measuring unique accounts instead of volume. Notably, 76.69% of all Bitcoin traders on the leading crypto exchange had long positions by June 25. This represents a 3.29:4 ratio for this market alone. Binance represents over 50% of Bitcoin’s global trading volume.

Bitcoin BTCUSDT Long/Short (Accounts). Source: CoinGlass

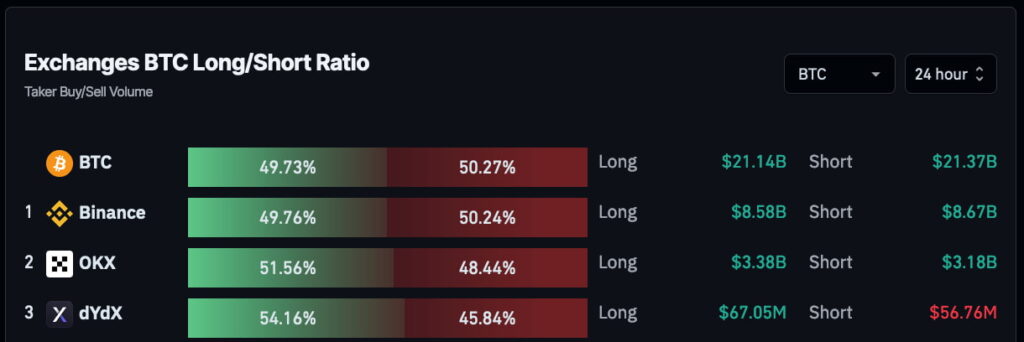

However, there is a clear divergence between the number of unique accounts (users) and the volume deployed to these positions. The volume-based 24-hour long/short ratio shows a different scenario with $8.67 billion shorts over $8.58 billion longs.

Exchanges BTC Long/Short Ratio. Source: CoinGlass

Bitcoin whales could long squeeze retail

This suggests that while retail is positioning with bullish long positions, derivatives whales are slightly biased toward a bearish stance. Thus, these whales could, at one point, decide to liquidate the massive amount of individual retail users betting on Bitcoin.

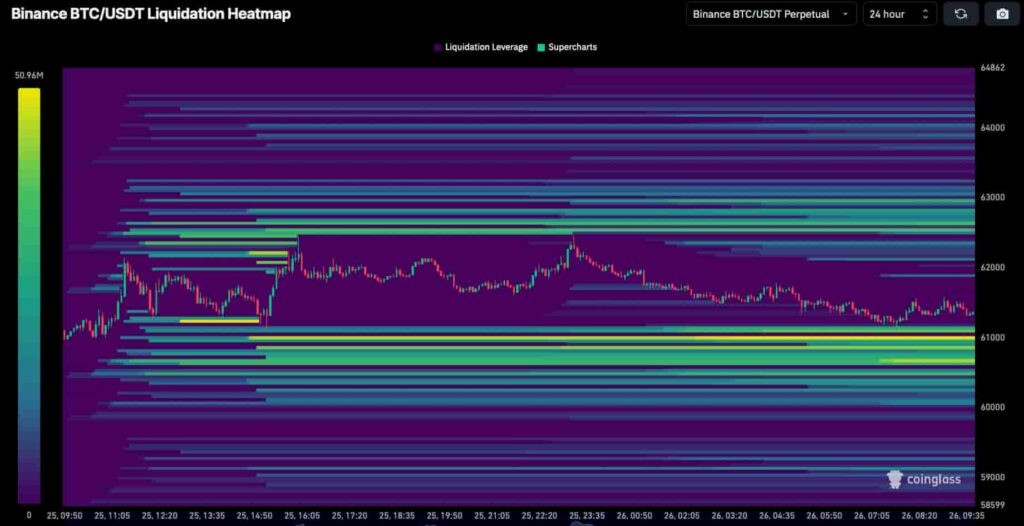

Such liquidations could cause a long squeeze, dropping BTC prices to lower levels and rewarding the short-selling Bitcoin whales. Notably, looking exclusively at Binance, the described behavior has created liquidity pools to the downside, which can become whales’ targets.

Binance BTC/USDT Liquidation heatmap. Source: CoinGlass

As of this writing, the cryptocurrency trader and analyst Ali Martinez has spotted a similar behavior from Binance’s retail. According to Martinez, 72% of Bitcoin speculators on Binance hold open long positions.

72.19% of all accounts in @binance with an open #Bitcoin position are going long! pic.twitter.com/jV1lkjTXnC

— Ali (@ali_charts) June 26, 2024Interestingly, the derivatives market has been having a greater influence on Bitcoin over time. Finbold reported both a diminishing spot trading and on-chain transaction volume for BTC, on June 2—a trend that continues true. Moreover, Finbold covered Kaiko‘s report, addressing Bitcoin’s weekend volume dying out.

Investors, especially leveraged traders, must be cautious moving forward as analysts expect volatility from the leading cryptocurrency. Mt. Gox will start its repayments on July 1, and Germany’s government has been selling millions of dollars in BTC, both creating significant selling pressures that may affect the price.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.