XRP continues to remain in familiar territory, trading in the red zone as the token encounters further losses.

Notably, XRP is a subject of ongoing speculation, having failed to rally and instead consolidating below the $1 mark. Part of the token’s woes can be attributed to the ongoing Ripple and Securities Exchange Commission (SEC) case.

Part of XRP’s downturn is attributed to the overall market sentiment that has impacted assets such as Bitcoin (BTC). The token needs a significant shift in its price action to avoid further declines, as bears remain in control.

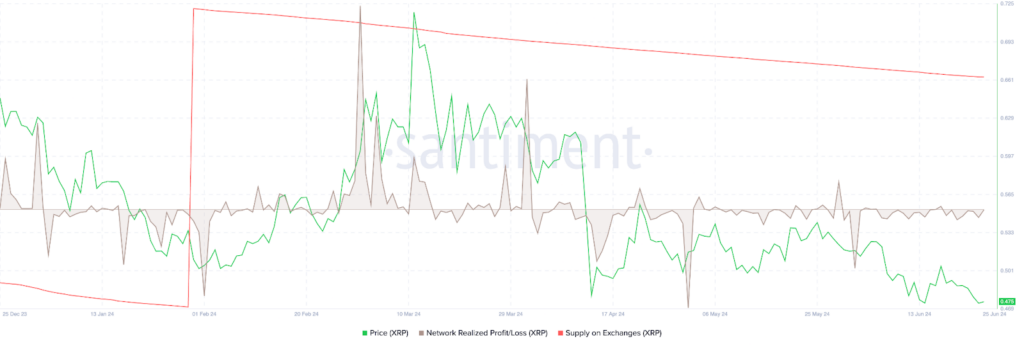

XRP NPL chart. Source: Santiment

Additionally, the possibility of further downside from the planned token unlocks is likely causing concern among investors. Notably, as reported by Finbold, XRP plans to unlock 1 billion tokens on July 1, worth $470 million, as part of Ripple’s monthly sell-offs, which could negatively impact the XRP price in the coming weeks.

In the meantime, XRP’s correction has coincided with ongoing regulatory developments. This follows SEC Chair Gary Gensler’s allegations that the crypto sector has harmed the public, comments that have rattled the crypto sector.

For instance, Ripple CEO Brad Garlinghouse criticized Gensler’s statement, terming it “absolute nonsense.”

Absolute nonsense coming from @GaryGensler today. And this slander about “all crypto execs going to jail” from the man who completely missed FTX (and actually cozied up to SBF), and wasn’t even invited to the DOJ announcement about Binance. If he was really “working for the… https://t.co/c3ynB5Gncl

— Brad Garlinghouse (@bgarlinghouse) June 25, 2024XRP price analysis

At press time, XRP was trading at $0.46 with daily losses of almost 0.5%. On the weekly chart, the token is down by over 6%.

XRP seven-day price chart. Source: Finbold

Overall, XRP’s lifeline depends on breaching the $0.50 resistance zone, which will inspire investor confidence in the asset.