Bitcoin (BTC) is showing signs of approaching a significant low, presenting a potential buying opportunity for investors and traders. Recent price movements indicate a gradual rounding off from its recent peaks, reflecting a slow but steady decline in market enthusiasm and buying pressure.

This trend suggests that a major low could be imminent, which savvy investors might leverage to their advantage.

Trading expert Alan Santana projected on June 26 that Bitcoin could soon test several key support levels. Currently, Bitcoin is hovering around the $62,473.33 mark, which corresponds to the 0.618 Fibonacci retracement level—a historically strong support during downtrends.

Bitcoin price analysis chart. Source: TradingView/Alan Santana

Should this level fail to hold, the next significant support lies at $59,883.97, the 0.786 Fibonacci retracement level. This zone could serve as a critical buying area if the price stabilizes there. If the decline continues, the price might drop further to the 1.236 Fibonacci extension level at $52,948.21, potentially presenting an even more attractive buying opportunity.

Technical indicators suggest potential decline

A closer examination of trading volumes reveals a concerning trend. Since mid-May, there has been a noticeable decline in trading volume, suggesting a weakening bullish momentum.

This decreasing volume trend indicates a reduction in market enthusiasm and the possibility of continued downward pressure on the price. Concurrently, an increase in bearish volume highlights stronger selling pressure, reinforcing the likelihood of further price declines.

Market sentiment also plays a crucial role in Bitcoin’s price movements, currently characterized by increased fear and uncertainty, contributing to the bearish trend.

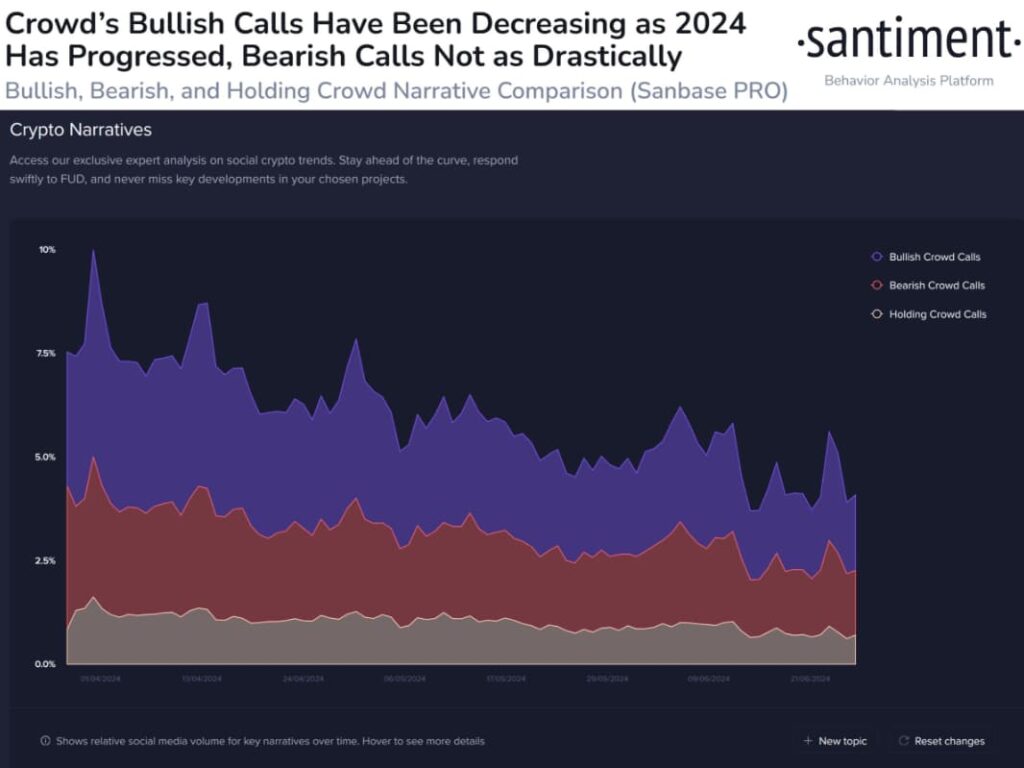

Data from crypto analytics firm Santiment shows a significant drop in bullish remarks across social media platforms like X, Reddit, Telegram, 4Chan, and BitcoinTalk in recent weeks.

Bitcoin drop in bullish sentiments. Source : Santiment

Since the Bitcoin halving in April, the price has been trading sideways. Trader sentiment was most bullish at the beginning of April but has waned over the past three months due to Bitcoin’s inability to reach new all-time highs.

While bearish sentiment has also declined, it hasn’t dropped as sharply as bullish sentiment. Santiment suggests this decline in trader euphoria could be a potential bottom signal.

Timing the next buying opportunity

Timing the next big buying opportunity in Bitcoin requires careful monitoring of key support levels and market conditions. In the short term, over the next one to two weeks, the crucial level to watch is $62,473.33.

If Bitcoin breaks this support, the price may quickly drop to the next support at $59,883.97. Investors should monitor for a potential breakdown and signs of reversal around this level.

A sustained hold above this level could signal a buying opportunity. In the mid-term, within a month, the key level to watch is $52,948.21. If the $59,883.97 support fails, expect a decline toward $52,948.21.

This level aligns with the 1.236 Fibonacci extension and is likely to attract significant buying interest. Investors should prepare to enter the market if Bitcoin approaches this level and shows signs of bottoming out.

Bitcoin price analysis

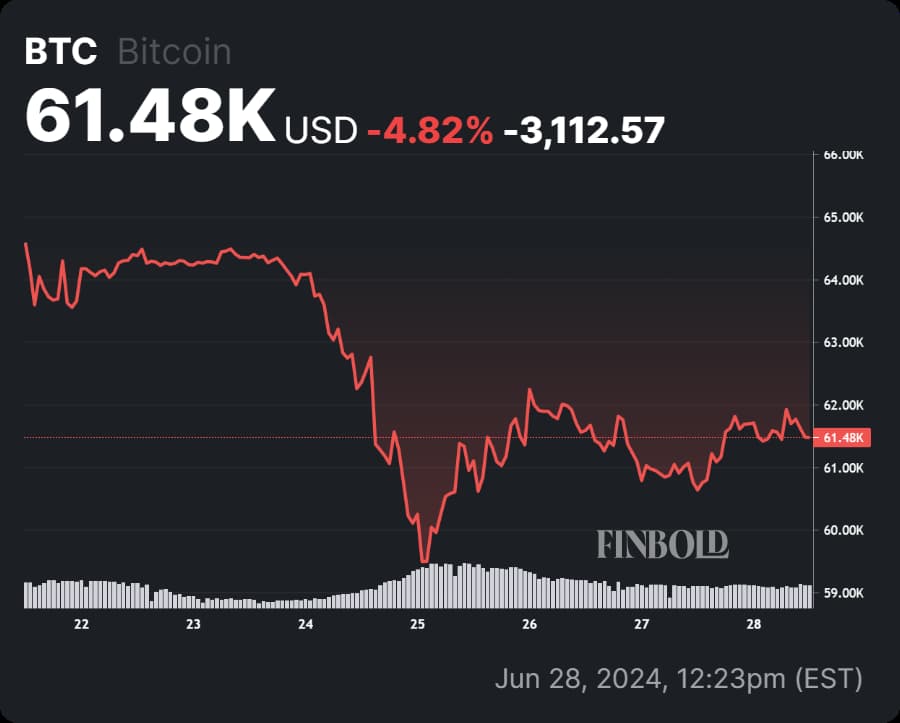

At present, Bitcoin is priced at $61,523.01, with a 1.3% increase in the past 24 hours. Despite this short-term gain, the broader trend remains downward. The current price formation, combined with Fibonacci retracement levels and trading volume trends, suggests a potential for further price declines.

BTC 7-day price chart. Source: Finbold

Investors should prepare to seize the next big buying opportunity by closely monitoring the $59,883.97 and $52,948.21 levels.

Investors should remain vigilant, watching for critical support levels at $62,473.33, $59,883.97, and $52,948.21. By carefully monitoring these levels and market conditions, they can potentially capitalize on significant buying opportunities as Bitcoin approaches these key points.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.