Solana (SOL) was one of the top-performing cryptocurrencies during this cycle, attracting retail and institutional interest due to its network scalability and transaction efficiency. Finbold selected two promising Solana competitors to consider for the second half of 2024.

Notably, SOL had an impressive 19,873% rally in 2021 and another remarkable recovery from the 2022 bottom. In the previous bull market, Solana went from $1 to $260 in less than 12 months. Later, it made from $8 to $204 in one and a half years, currently trading at $140 per token.

SOL/USD weekly chart. Source: TradingView (CRYPTO index)

Solana positioned itself as a strong competitor to Ethereum (ETH), the leader in Web3 and decentralized finance (DeFi). In particular, the network offers a much higher throughput measured by transactions per second (TPS), faster confirmation, and cheaper fees.

MultiversX (EGLD) year-to-date price chart. Source: Finbold

Radix (XRD) scalability and price analysis

On the other hand, Radix still does not have sharding implemented in the mainnet. Instead, the blockchain is currently testing this implementation with promising results. Additionally, the project bets on having atomic composability for all its transactions, which translates to a seamless user experience while using different shards.

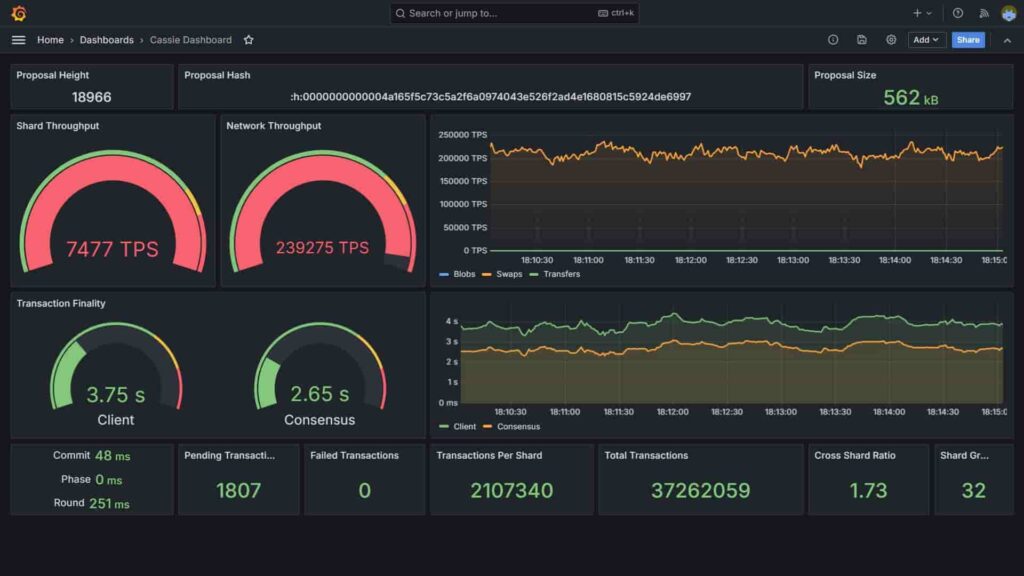

Dan Hughes’s recent tests suggest the network will be able to handle over 200,000 swaps per second. Swaps are more complex transactions that usually achieve lower throughputs than usual TPS. The testnet confirmed these swaps in 3.75 seconds, on average, using 32 shards.

Radix testnet. Source: Dan Hughes

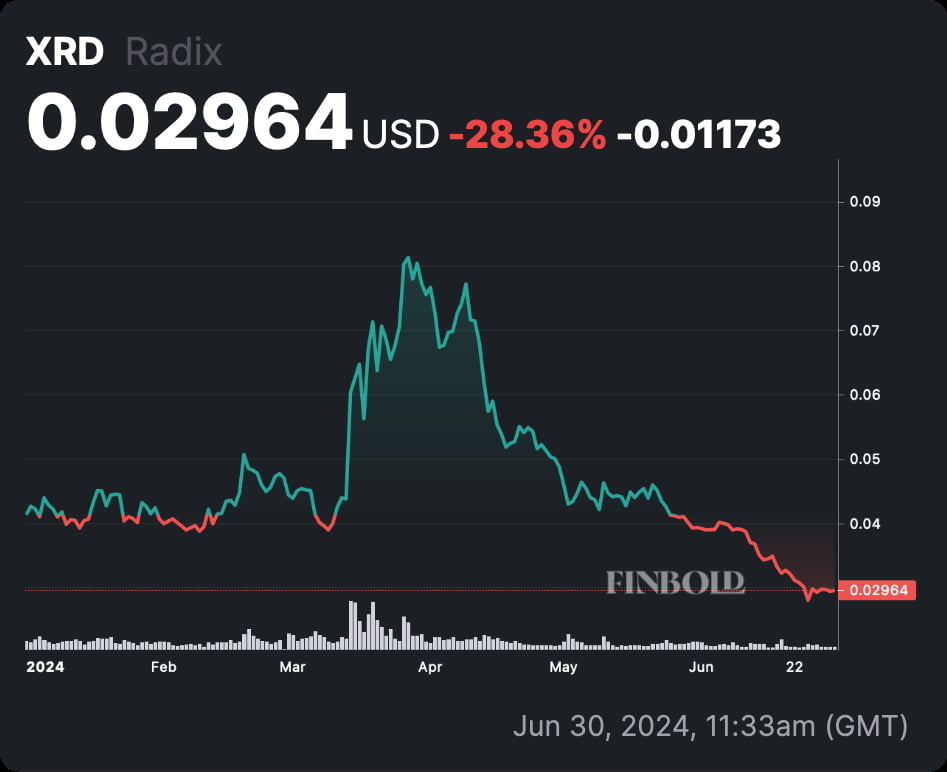

In the meantime, XRD is priced at $0.029, below its Initial Coin Offering (ICO) price. It is down 28% year-to-date and has a $300 million market cap, which represents a 216 times lower capitalization than Solana’s.

Radix (XRD) year-to-date price chart. Source: Finbold

However, both EGLD and XRD present considerable risks for investors despite their promising technology. Investors must be cautious and do their due diligence before making any financial decision, as these low-cap cryptocurrencies could still perform negatively.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk