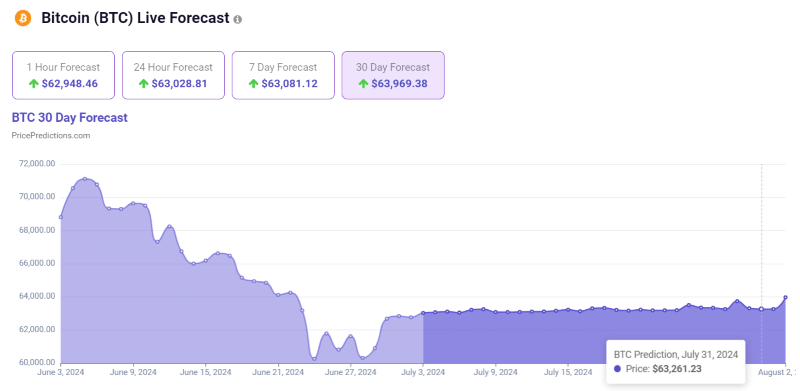

As Bitcoin (BTC) returns in the realm above $62,000, the flagship decentralized finance (DeFi) asset still seems to struggle with retaking the $63,000 level, but certain machine learning and artificial intelligence (AI) algorithms expect it will manage to succeed by the end of July.

Indeed, the price action of Bitcoin has recently suffered a bearish streak that continued for the majority of the month, only managing to recuperate for a short time in the past several days before dropping again below the $63,000 level in the last 24 hours.

Bitcoin price 30-day forecast. Source: PricePredictions

This means that Bitcoin could advance 0.88% from its current price, should these projections, which rely on technical analysis (TA) parameters like average true range (ATR), Bollinger Bands (BB), and moving average convergence divergence (MACD), come true.

Bitcoin price analysis

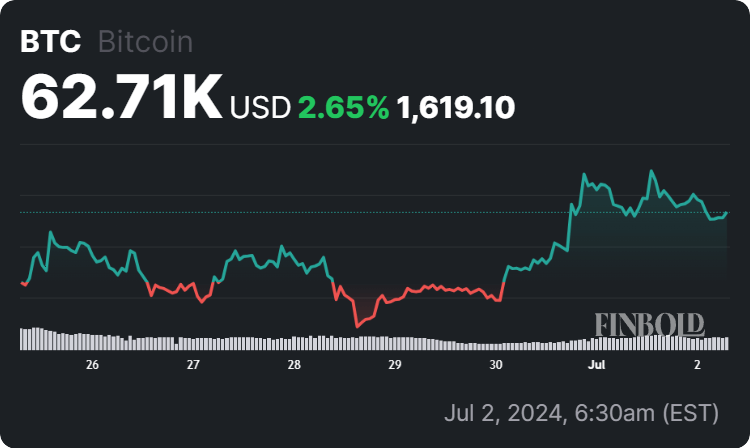

For now, the maiden crypto asset is trading at the price of $62,710, which reflects an increase of 0.22% in the last 24 hours and a 2.65% growth across the previous seven days while accumulating a loss of 8.08% over the past month, according to the most recent charts.

Bitcoin price 7-day chart. Source: Finbold

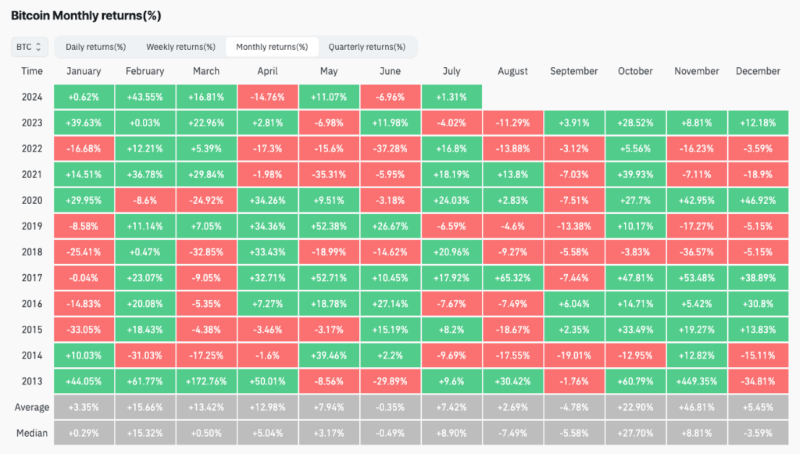

Another optimistic sign for Bitcoin is the fact that, historically, its June slump in monthly returns would precede a July rally, which has happened for the seven last July trading periods, with the exception of 2014, 2016, 2019, and 2024, recording at least 8% gains, and up to 24%, as CoinGlass data demonstrates.

Bitcoin monthly returns. Source: CoinGlass

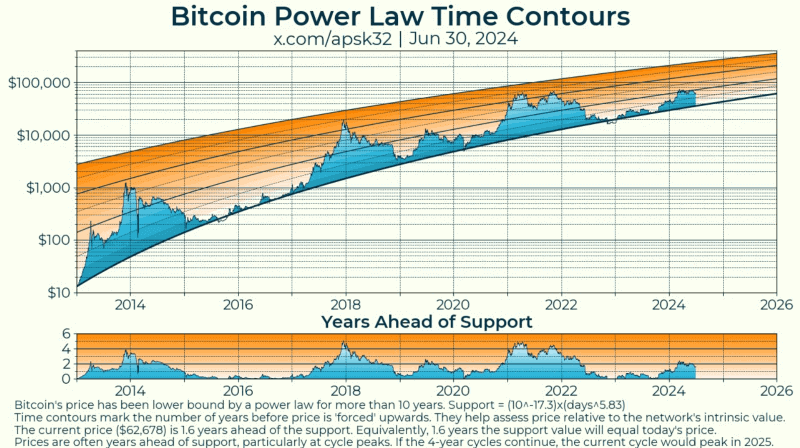

It is also important to note that pseudonymous crypto analyst apsk32 recently observed that Bitcoin’s price has adhered to a power law for over a decade, which indicates a fundamental growth process in the Bitcoin network, something not typically present in traditional financial markets.

In line with such a behavior, the expert has shared a long-term Bitcoin price forecast that sees the largest asset in the crypto industry by market capitalization reaching $300,000 by the end of 2025, if the four-year cyclic pattern of bull markets continues, as Finbold reported on July 1.

Bitcoin price performance analysis. Source: apsk32

Ultimately, Bitcoin price at the end of this month might end up at the level projected by the AI algorithm, particularly as experts concur. However, trends in the crypto market can sometimes change unexpectedly, so doing one’s own research and understanding the risks is critical when investing.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.