Two cryptocurrencies have made the headlines in the last 24 hours and are trending with a dominating negative sentiment. In particular, cryptocurrency investors should avoid Polkadot (DOT) and Bittensor (TAO) this week amid looming fear, uncertainty, and doubt (FUD).

These two cryptocurrencies featured in the top five trending coins on Santiment‘s social trends. TAO was the most trending coin by social volume, with a dominating negative sentiment.

Overall, the cryptocurrency market experiences losses following a Bitcoin (BTC) crash to an important support zone. This could impact the whole ecosystem, specifically these two projects that recently faced controversy and negative news.

Trending Coins. Source: Santiment

Bittensor (TAO)

Notably, Bittensor’s blockchain suffered a major security breach on July 3. Attackers drained $8 million worth of TAO tokens from user wallets. The team arbitrarily halted all transactions on the network to contain the exploit. Bittensor’s core members assured users they were taking steps to prevent further mishaps. They paused the chain, putting it in “safe mode” to investigate the attack’s nature.

This unilateral decision and demonstration of control over the blockchain have raised criticisms in the community, highlighting centralization issues.

As developed, Blockchain trackers show the last transactions occurred around 23:00 UTC on Tuesday. Security researcher ZachXBT suspects a private key leakage led to the attack. However, the investigation into the attack is still ongoing as of Wednesday morning.

Furthermore, this security breach has raised concerns about the project’s vulnerability. Investors may approach TAO with caution in the coming weeks as doubt looms and the hackers could dump the tokens, harming the price.

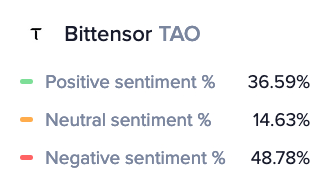

Currently, 48.78% of all Bittensor mentions on social media reference a negative sentiment.

Bittensor TAO, sentiment. Source: Santiment

Polkadot (DOT)

Meanwhile, Polkadot faces criticism for its recent spending habits, raising concerns about its financial stability. The company’s treasury report reveals $87 million in expenditures for the first half of 2024.

Over 42% of this spending went towards outreach activities, including influencer partnerships and sponsorships. Polkadot’s treasury revenue has significantly decreased, dropping from 414,291 DOT to 171,696 DOT.

Head ambassador Tommi Enenkel suggests the company has about two years of runway left. CEO Fabian Gompf disputes these claims, stating the treasury will never run out of funds. He acknowledges excessive spending on low ROI activities and encourages community voting for change.

Critics highlight a $53,000 invoice for a six-month animated logo on CoinGecko as an example of bad habits. Venture capitalist Adam Cochran describes Polkadot’s outreach spending as “lighting money on fire.” The company’s financial decisions have sparked debate about its future sustainability and resource allocation.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.