Five cryptocurrency whales have sold nearly $8 million in Lido (LDO) tokens following a Securities and Exchange Commission (SEC) enforcement. These crypto whales have sent 4.44 million LDO to a Binance address at over $2.6 million losses.

Notably, a report by SpotOnChain suggests that these five whale addresses belong to three unique, highly capitalized investors. According to the report, these five whales moved nearly at the same time, with a few minutes difference.

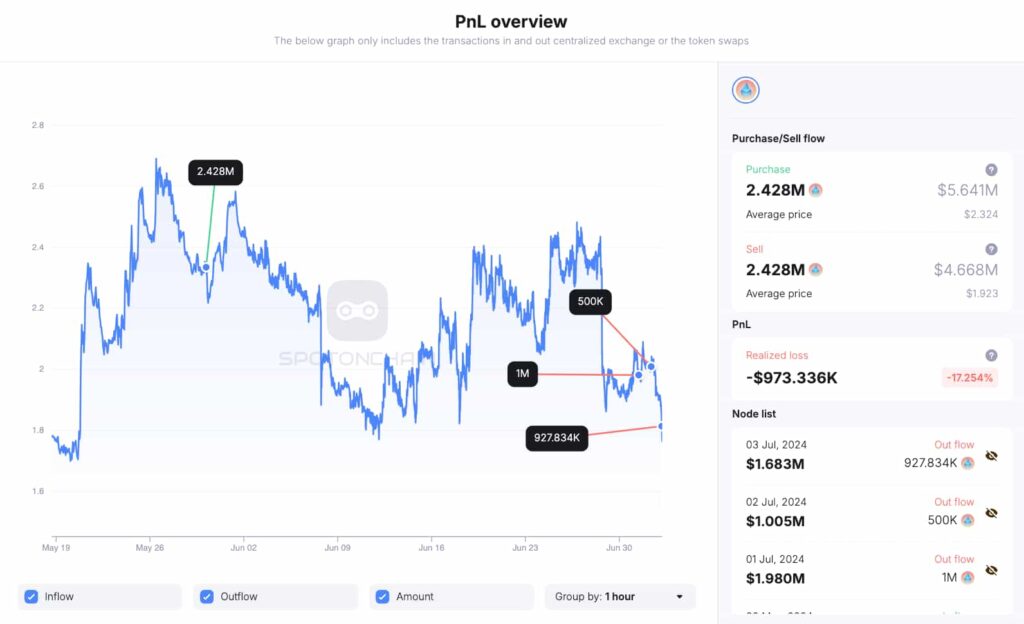

0xd7c5deb9fa0ac9ab71cf5f53cb380bf1e6fe9730 PnL overview. Source: SpotOnChain

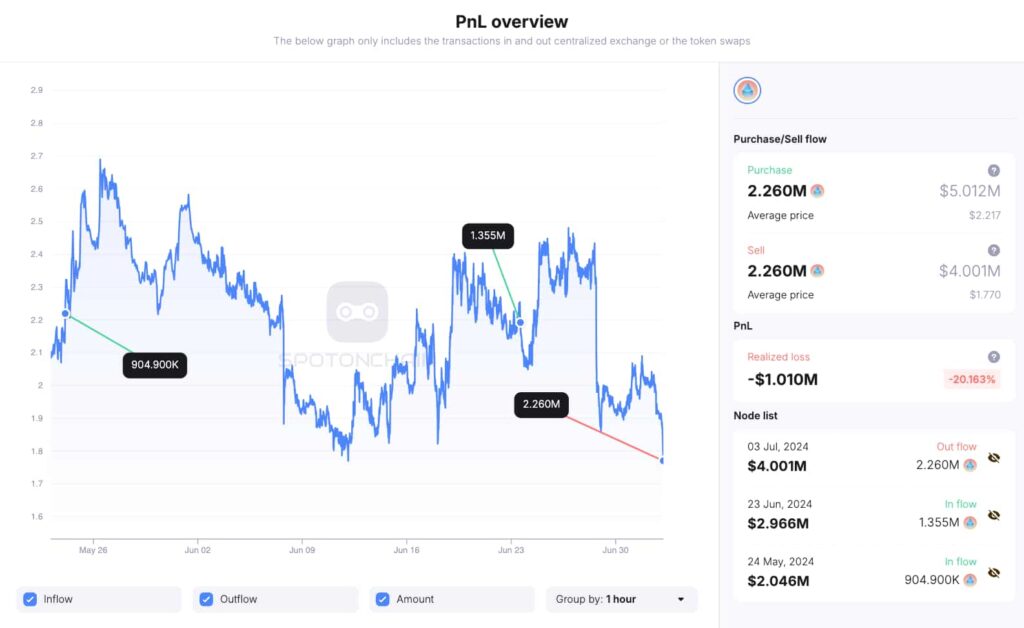

Next, the crypto addresses 0x287 and 0x7Ee supposedly belong to the same entity. On that note, the ‘Whale 0x287+0x287’ deposited all its 2.26 million LDO holdings at a nominal value of $4 million and an estimated loss of $1 million after one month of the initial investment.

Notably, the wallets withdrew those LDO tokens from Binance at $2.217 on average, at an estimated cost of $5.01 million on May 24 and June 23, 2024.

‘Whale 0x287+0x287’ PnL overview. Source: SpotOnChain

Finally, the wallets 0xBD0 and 0x423 have liquidated all the 1.25 million LDO, worth $2.23 million, after a month of acquiring these tokens.

‘Whale 0xBD0+0x423’ withdrew those LDO tokens from Binance at $2.289 on average at an estimated cost of $2.87 million on May 24 and June 23, 2024. Resulting in estimated losses of $643,000.

SEC targets Lido as unregistered securities

On June 28, the United States SEC sued Consensys over the MetaMask Ethereum (ETH) staking service. Interestingly, the lawsuit mentioned Lido and Rocket Pool as illegal services.

This enforcement action brought fear, uncertainty, and doubt regarding the Lido protocol, possibly affecting these whales’ conviction in the project and with their investments in the LDO token.

As of this writing, LDO trades at $1.73 and is down 24% in the last seven days. Essentially, the major crash happened after the SEC lawsuit against Consensys.

Lido (LDO) 7-day price chart. Source:

Investors must be cautious when using the Lido platform and trading the LDO tokens while regulatory uncertainty looms.