Bitcoin (BTC) lost a four-month price range with a three-day 14.74% crash to $53,540 on July 5. In the last 30 days, BTC lost over 25% of its market value, ending an all-time “longest winning streak.”

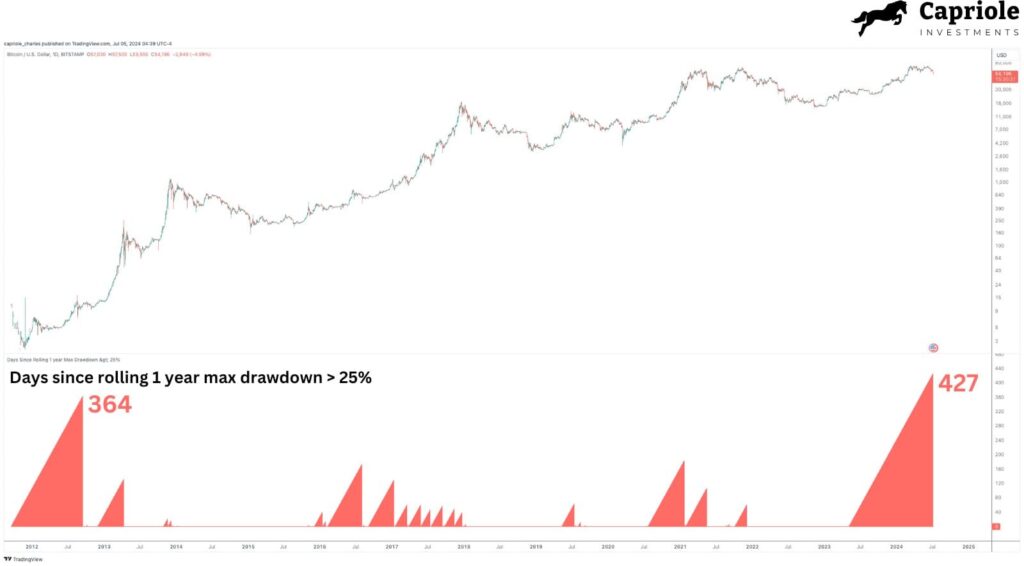

Capriole Investments‘ crypto analyst Charles Edwards reported this milestone on X, highlighting Bitcoin’s 427-day winning streak without a 25% drawdown. Essentially, it is the first time in history that Bitcoin has gone without such a correction for 427 days.

Edwards called it a “pretty incredible run” and a “well overdue correction” for the leading cryptocurrency.

BTC indicator: Days since rolling 1-year max drawdown >25%. Source: Capriole Investments

Crypto market crash and liquidations

As reported by Finbold, cryptocurrency traders have lost more than $662 million in liquidations from July 4 to 5. Of that, 85% were long-position liquidations, and Bitcoin dominated those by 35%.

Notably, the crash started on July 3, with the crypto total market cap index by TradingView (TOTAL) marking a $2.25 trillion capitalization back then and going as low as $1.90 trillion this morning as traders started panic selling.

The drop represents a $311 billion market cap loss in approximately 60 hours, being one of the worst hits recently.

Crypto Total Market Cap Index (TOTAL), daily chart. Source: TradingView

Bitcoin price analysis, macroeconomics, and sell-offs

Overall, Bitcoin went from $72,000 28 days ago to as low as $53,542 this Friday. The cryptocurrency lost 25.67% after a resistance rejection and broke down from the four-month range’s support of $60,000.

As of this writing, BTC trades at $55,270 and will retest the price range.

Bitcoin (BTC) daily price chart. Source: TradingView

Interestingly, the published United States macroeconomic data suggests a weakening labor market. Non-farm payrolls show 206,000 new jobs added this month, 12,000 less than in June. Moreover, the unemployment rate came above expectations at 4.1%. This fuels fears of an impending recession in the U.S., which could make the Federal Reserve review its aggressive interest rate policy.

Thus, Bitcoin could benefit from this data, renewing investors’ confidence amid massive sell-offs from Mt. Gox and Germany that triggered panic sales over the market.

As all this developed, traders expect increased volatility for crypto assets in the coming days, requiring extra caution with leverage positions moving forward.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.