As Bitcoin (BTC) aims to reclaim the $60,000 support, an analyst has opined that the asset’s past performance indicates more upside potential, possibly reaching six figures.

According to the analyst with the pseudonym apsk32, Bitcoin could be on a trajectory to reach $225,000 in the next several months.

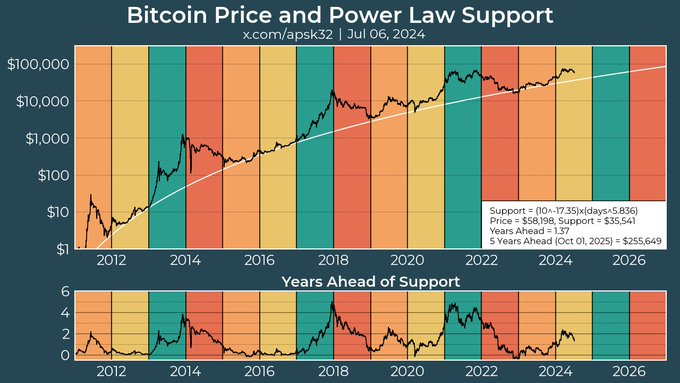

The analyst, in a post on X on July 7, noted that the projection is based on an assessment of Bitcoin’s historical price movements and its alignment with a power law support model.

Bitcoin price and power law support. Source: apsk32

The fundamental assertion made by Apsk32 is that if Bitcoin follows its previous cycle patterns, it could be five years ahead of the power law support by October 2025. This would place Bitcoin’s price at approximately $255,000 on that date.

“If bitcoin is 5 years ahead of the power law support on 1 Oct 2025 then it will be worth $255,000,” the analyst said.

Bitcoin’s short-term targets

Notably, the recent acceleration in Bitcoin’s price in 2024 indicates a potential deviation from past cycles. However, the expert remained cautious, noting that similar sentiments have been expressed during previous cycles, only for the pattern to hold ultimately.

Indeed, for Bitcoin to reach the $255,000 mark, investors will focus on key short-term targets. In the current cycle, attention is on Bitcoin hitting a new all-time high of $100,000.

Although short-term bearish sentiments have derailed the move toward this level, most of the market expects that once the post-halving rally kicks in, Bitcoin will potentially hit the target.

As things stand, Bitcoin is aiming to reclaim the $60,000 support. As reported by Finbold, crypto analyst Ali Martinez pointed out that for Bitcoin to resume its bull run, the maiden crypto needs to reclaim $61,000 and hold the position.

Bitcoin price analysis

Bitcoin was trading at $57,526 at press time, reflecting daily gains of over 1%. On the weekly chart, Bitcoin is down over 6%.

Bitcoin seven-day price chart. Source: Finbold

In the meantime, Bitcoin bulls are in the spotlight to hold the current position as the market seeks to move away from the panic that emanated from the Mt. Gox repayments.

Disclaimer:The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.