After an impactful cryptocurrency market crash last week, a bearish sentiment looms over most cryptocurrencies, creating speculative imbalances and liquidity. In particular, two cryptocurrencies are currently dominated by short-sellers, creating interesting dynamics that could favor a short squeeze.

For this analysis, Finbold retrieved data from CoinGlass on July 7. We looked at the funding rate of the most traded cryptocurrencies in the derivatives market, ordering by the highest open interest (OI).

Basically, a negative funding rate appears when there is more open interest in short positions than longs. Therefore, the crypto exchange algorithm makes short-sellers pay an APR to long-position traders, incentivizing a balance.

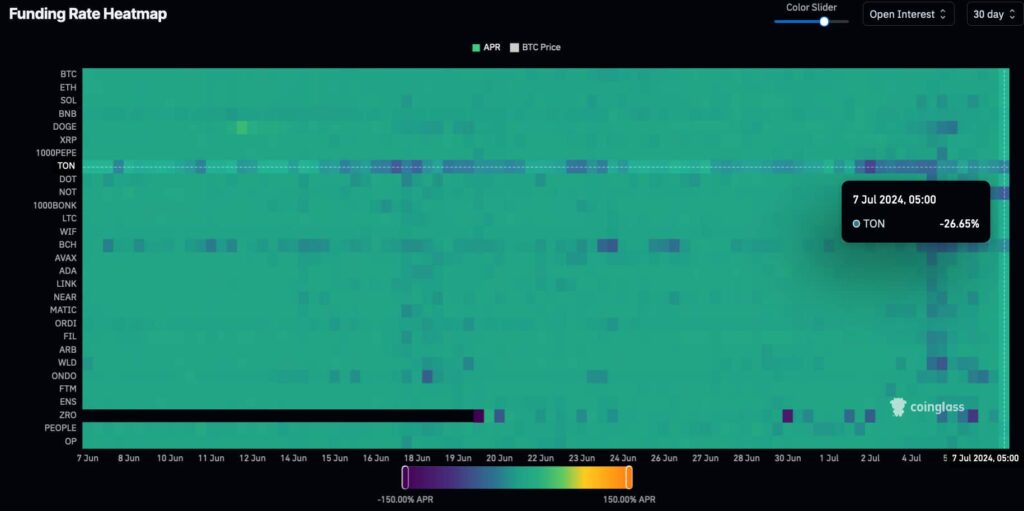

Funding Rate Heatmap: TON. Source: CoinGlass

Despite the negative funding rate, TON’s derivatives volume dropped by 43% in the last 24 hours. Therefore, it’s possible that the current $295.34 million open interest may not be enough to trigger a short squeeze. This is because the dropping volume suggests short-sellers are closing their now expensive positions with a 26.65% annual cost.

TON open interest data. Source: CoinGlass

Notcoin (NOT) short squeeze alert

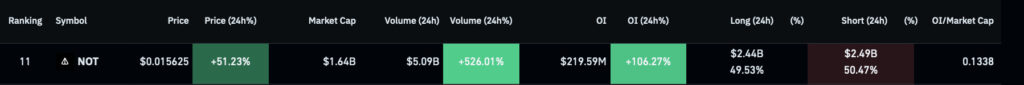

Conversely, Notcoin (NOT) has risen to the eleventh largest open interest in the market, with a 526% volume surge. The $1.64 billion capitalization token has a $219.59 million open interest for a 0.1338 OI/MCap ratio.

NOT open interest data. Source: CoinGlass

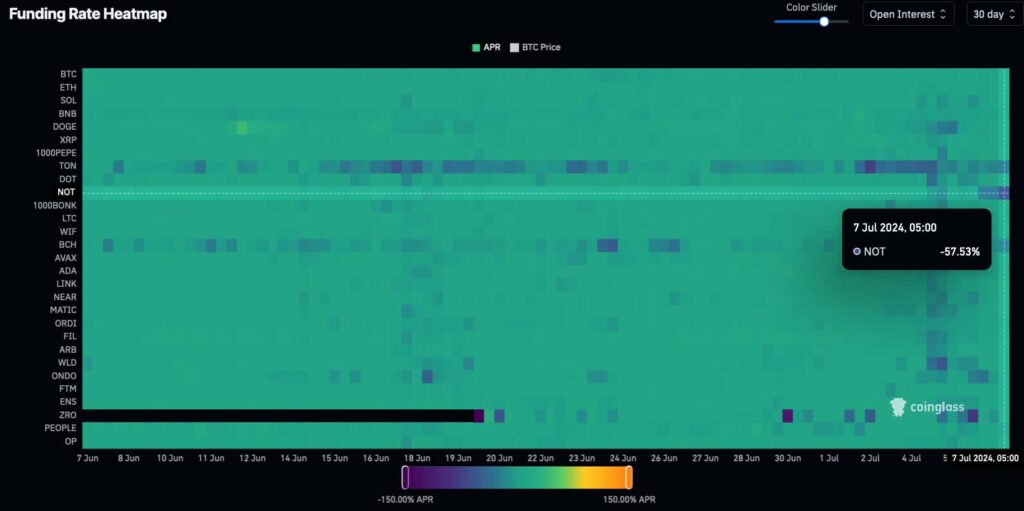

Notably, this increases the likelihood of a short squeeze, considering a remarkable 57.53% negative funding rate. NOT is a play-to-earn token integrated into the TON Blockchain and the Telegram wallet.

Funding Rate Heatmap: NOT. Source: CoinGlass

However, it’s worth noting that such an increased open interest and surging volume to open short positions is usually bearish. This market movement suggests investors and traders are betting in lower prices for TON and, especially, NOT.

If this sentiment is fueled by fundamental matters and negative news, a short squeeze may never happen as price downtrends. These highly shorted coins need some bullish news and events to trigger a surge and, thus, a short squeeze.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.