Dozens of meme coins surged in the cryptocurrency market following Donald Trump‘s assassination attempt on July 13, including $FIGHT. Crypto insiders have benefited from the buzz to turn nearly $5,000 into over $7 million, frontrunning retail traders.

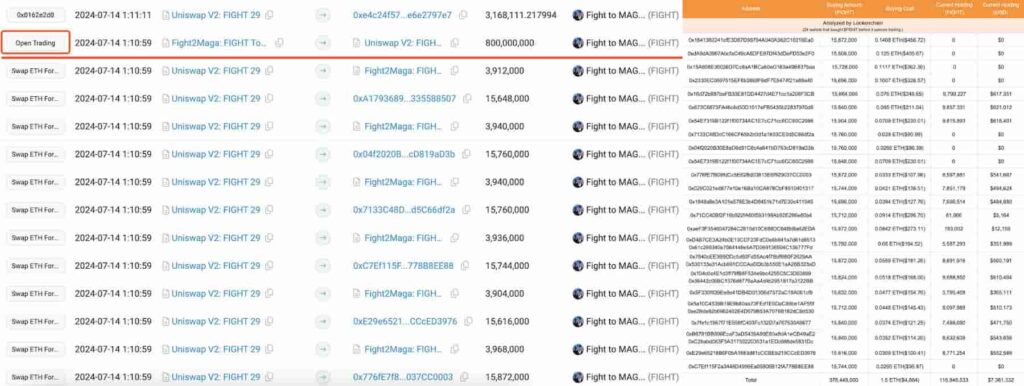

Lookonchain detected and reported this insider trading on the Ethereum (ETH) network, a cautionary tale of this market’s dangers. In particular, the researcher found 24 crypto wallets belonging to insiders or developers given suspicious and telling trading activity.

According to Lookonchain, these 24 addresses spent 1.5 ETH, worth $4,864, to buy 378.45 million $FIGHT. This amount represents 37.8% of the token’s total supply, and the wallets made the purchase before $FIGHT opened trading.

Crypto insiders activity with $FIGHT. Source: Lookonchain / Etherscan

Crypto insiders create asymmetry on $FIGHT, punishing retail traders

This is another example of how crypto insiders often take advantage of retail by creating and launching meme coins and money-grab schemes. They benefit from information asymmetry and the hype of a market that insists on gambling with poor fundamental digital assets.

Cryptocurrencies are inherently volatile and present considerable risks for traders, investors, and users, even with solid and usable projects. However, trading meme coins adds another layer of risks that will often drain money from many to a few insiders.

Moreover, this asset class has characteristics that resemble financial bubbles. The “Greater Fool Theory” explains meme coin dynamics, being speculative tokens moved by social hype and buzz without an organic demand.

Traders buy the token with the expectation that a “greater fool” will pay a higher price in the future. Nevertheless, the scheme fades away once there are no “greater fools” to continue fueling the price up, often facing liquidity issues and death spirals.

For this reason, investors should avoid trading meme coins and projects favored by crypto insiders, looking for a cryptocurrency‘s fundamentals and cautiously researching its properties.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.