The Uniswap (UNI) team-linked wallet sold nearly $10 million of tokens on July 19 in a month selling spree. So far, the labeled address has dumped 5.98 million UNI in July, worth nearly $50 million.

SpotOnChain reported this activity, following the address ‘0x63b‘, which received 9 million UNI from the initial distribution in September 2020. According to the platform, this allocation came from the team/investor/advisor category of the project’s disclosed tokenomics.

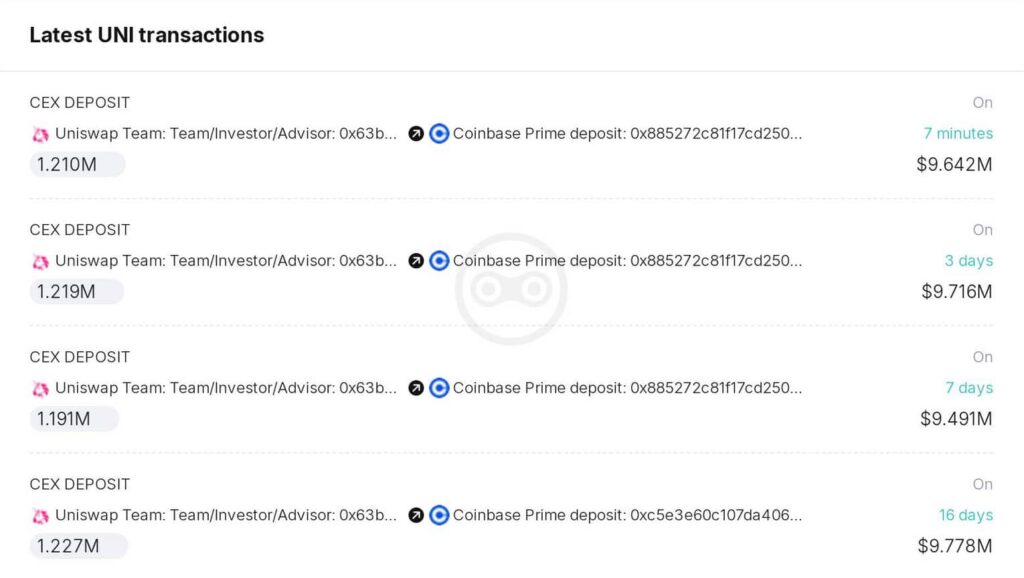

As reported, ‘0x63b’ has deposited 5.98 million UNI to Coinbase Prime at an average of $8.26 since July 4, resulting in a nominal value of $49.4 million. Notably, the most recent deposit was 1.21 million UNI in a single day, worth $9.64 million.

Latest UNI transactions (0x63b53181bdc48a9fbf1d23d461d3cfd82b0abc83). Source: SpotOnChain

Crypto whales absorb Uniswap team’s sell-off

SpotOnChain, however, observed that these offloads were “quickly absorbed” by other Uniswap whale addresses, not significantly affecting the cryptocurrency’s price.

Particularly, four whale addresses stood out, withdrawing 1.04 million UNI from Coinbase Prime right after the most recent deposit. With that, these addresses alone absorbed 85% of the 1.21 million tokens from the Uniswap team-linked wallet.

This highlights a relevant demand for the Uniswap token.

Uniswap (UNI) price analysis

In the meantime, the Uniswap native token was trading at $7.90 by press time, down 22% in one month. Therefore, despite the recent whale buying activity, UNI has suffered from a significant selling pressure, impacting its price.

Uniswap (UNI) one-month price chart. Source: Finbold

As of the reporting time, the ‘0x63b’ address held 3.02 million UNI, worth $24.07 million, which will likely be deposited to Coinbase Prime at one point. Interestingly, this is half the amount the project team has sold month-to-date.

Uniswap is the largest decentralized exchange (DEX) in the cryptocurrency market, moving relevant trading volume daily, although not directly benefiting the token’s fundamentals.

Now, decentralized finance (DeFi) investors look further to see whether the Uniswap team’s movements will cause from an economic perspective.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.