A cryptocurrency trader deposited $2.1 million worth of Synthetix (SNX) to Binance on July 20, capitulating from their entire SNX position with approximately $254,000 of realized losses.

SpotOnChain data shows the capitulation activity from the whale address ‘0x921‘, suggesting the trader believes in further losses for Synthetix. Usually, crypto whales can have a strong influence on cryptocurrencies‘ price dynamics, so they are worth following for insights.

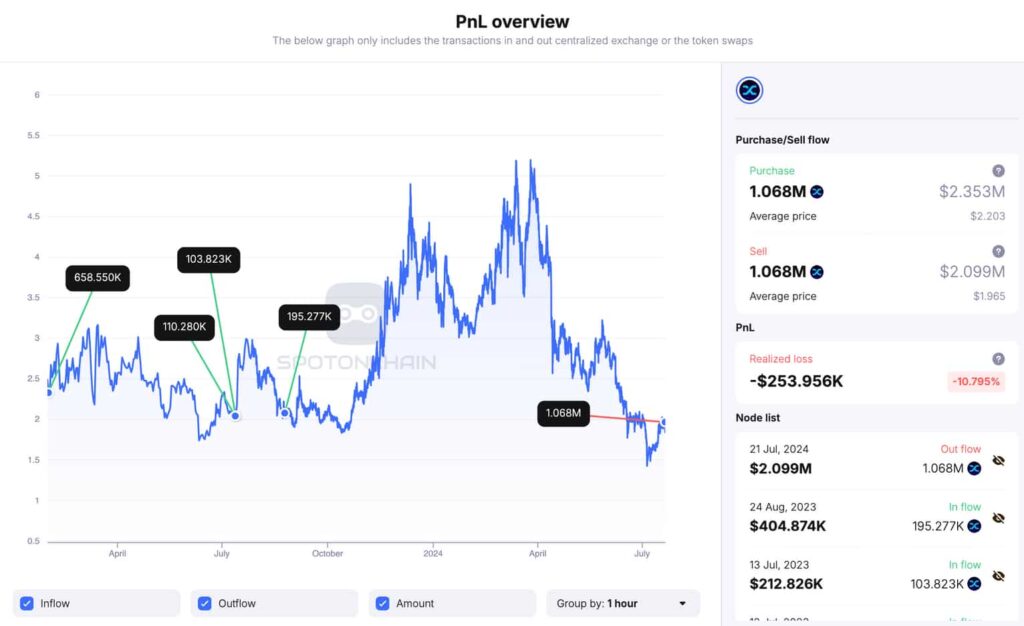

In particular, this crypto trader acquired 1.07 million SNX in four withdrawals at a dollar-cost average of $2.203. These purchases happened from January 31 to August 24 at an estimated cost of $2.35 million.

0x921e374c304e681ff4b87b9e239cb6c03147c3e1 PnL overview (SNX). Source: SpotOnChain

Other Synthetix traders’ activities and capitulation

Notably, SpotOnChain has monitored other Synthetix whales’ trading activity, and it appears that capitulation is a trend. Traders normally capitulate as a strategy to manage losses. This may happen when they expect an asset to drop further or when evaluating the cost of opportunity with competing assets.

On May 30, the crypto trader ‘0x97c’ deposited all their 594,350 SNX to Binance. At that time, this stack was worth $1.72 million for a relevant 27.4% loss of around $646,000. Moreover, another whale capitulated from Synthetix with massive losses of $2.18 million, selling for 31.1% less than their average buying price on June 2.

On the other hand, a smart trader decided to invest in Synthetix for the first time on July 7, at the bottom, buying 400,000 SNX for $637,000 on Uniswap (UNI).

This highlights how even whales can make mistakes in the unpredictable game of trading, especially when dealing with such a volatile asset class as cryptocurrencies. Crypto traders and investors must remain cautious and have a clear strategy before taking action, considering multiple different factors.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk