The Network Value-to-Transaction (NVT) ratio is a powerful cryptocurrency fundamental analysis indicator often used to spot overvalued and undervalued cryptocurrencies. On that note, Finbold encountered two networks with a better NVT ratio than Bitcoin (BTC), likely undervalued against the leader.

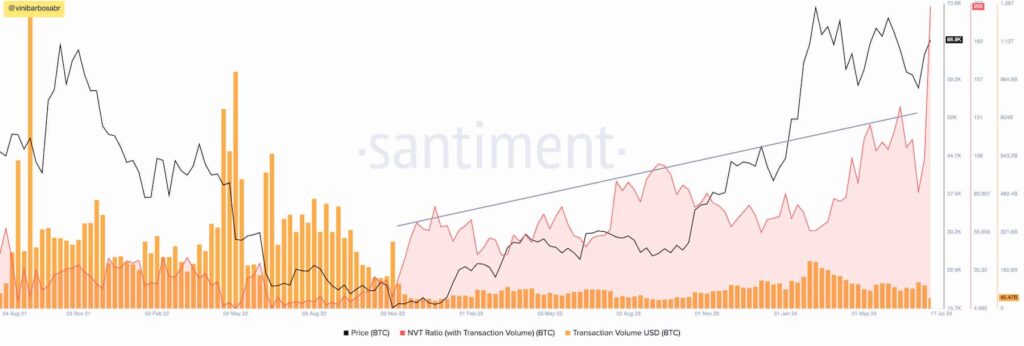

The leading cryptocurrency NVT has been on a notable uptrend since November 2022, as BTC’s demand started concentrating on off-chain transactions and derivatives trading – via futures contracts or spot Bitcoin ETFs.

We retrieved data from Santiment on July 21, showing an all-time high seven-day Network Value-to-Transaction ratio of 205.63. Essentially, Santiment calculates it by dividing Bitcoin’s market capitalization over the network’s transaction volume in the last seven days.

BTC: NVT + Transaction Volume in USD. Source: Santiment / Finbold (@vinibarbosabr)

Lower NVT: Undervalued cryptocurrencies against Bitcoin

Interestingly, other cryptocurrencies with a lower capitalization have been moving a proportionally higher value on their networks, suggesting an asymmetry. These coins could be undervalued against the market’s leader, offering an interesting opportunity for less conservative investors.

Litecoin (LTC): 2.59 NVT

First, Litecoin (LTC) shows a scenario that is directly opposite to Bitcoin, with an NVT downtrend as the network is processing a steady transaction volume despite the price drop.

As of this writing, LTC trades at $73.41, confirming $8.93 billion in a week. This results in an extremely undervalued 2.59 Network Value-to-Transaction ratio.

LTC: NVT + Transaction Volume in USD. Source: Santiment / Finbold (@vinibarbosabr)

Nano (XNO): 6.78 Network Value-to-Transaction

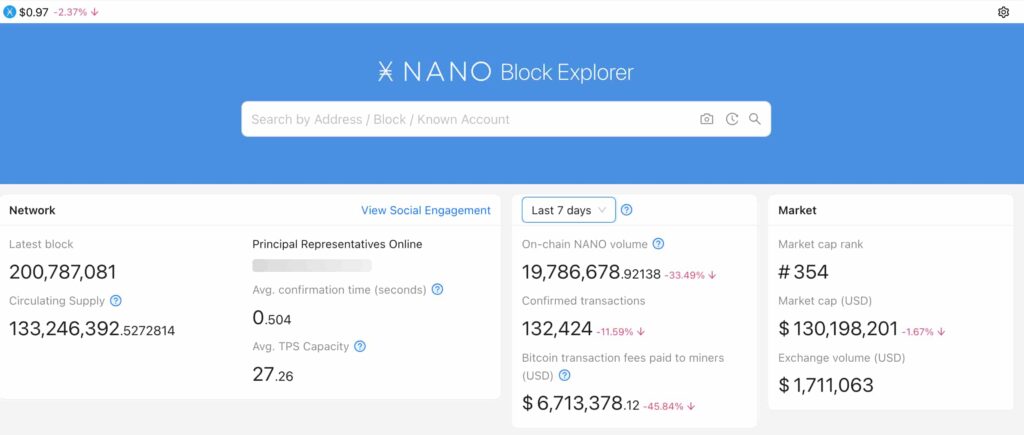

Notably, the Nano (XNO) network has confirmed 132,424 transactions worth 19.78 million XNO in the last seven days. Considering a $0.97 price per coin, it results in a $19.18 million seven-day transaction volume. Data is from BlockLattice.io.

The project currently has a $130.2 million market cap, considering a fully circulating supply of 133.24 million XNO. Thus, Nano’s Network Value-to-Transaction ratio of 6.78 suggests an undervalued cryptocurrency, weighted by its use and capitalization.

Nano (XNO) network and market data. Source: BlockLattice.io / Finbold

Nevertheless, having a low NVT does not guarantee these cryptocurrencies will outperform Bitcoin. This is a single fundamental analysis indicator that investors can use in addition to further analyses and research.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk