Ethereum (ETH) is trending as the Securities and Exchange Commission (SEC) finally approved exchange-traded funds (ETFs) using spot ETH as the underlying asset. Analysts expect an increased demand for Ethereum, benefiting related cryptocurrencies and other tokens as capital inflows to the ecosystem.

The native token Ether has seen over 25% gains in two weeks, highlighting the investment opportunity as Wall Street weighs in.

In particular, the decentralized finance (DeFi) trader and meme coin enthusiast Clouted explained the dynamic he expects to see.

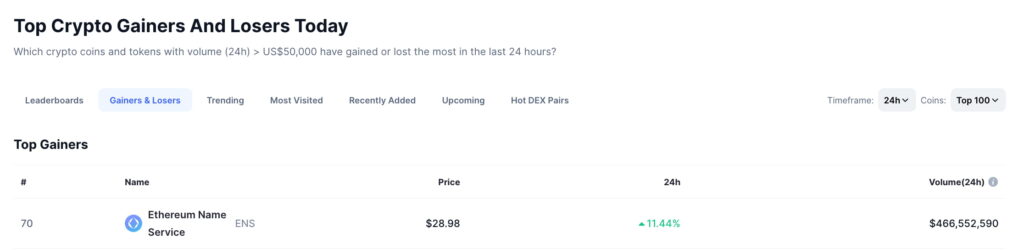

Top Gainers: Ethereum Name Service (ENS). Source: CoinMarktCap

Uniswap (UNI)

Uniswap (UNI) is the largest and most used decentralized exchange in DeFi, responsible for most of the traded volume. Thus, a capital inflow into the Ethereum ecosystem could directly benefit the project and its native token.

However, a Uniswap team-linked wallet has been selling millions of dollars of UNI, sounding an alarm for its investors. This has caused the UNI price to fall while cryptocurrency whales were seen buying these amounts, absorbing the supply.

Interestingly, the token is up 8.43% year-to-date at $7.82 by press time despite losing 50% of its yearly high at $15.4 in early March.

Uniswap (UNI) year-to-date price chart. Source: Finbold

In closing, the ETH ETF launch presents a valuable opportunity for the Ethereum ecosystem, and some tokens may stand out due to their fundamentals. Investors must do proper research before investing in these assets and understand that the cryptocurrency market is volatile and a risky investment.

Disclaimer:The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.