Over the years, investment magnate Warren Buffett has built a reputation for his skepticism towards cryptocurrencies, particularly Bitcoin (BTC), which he once termed “rat poison.”

Despite Buffett’s stance on cryptocurrencies, his investment firm, Berkshire Hathaway (NYSE: BRK.A), has nonetheless found success in the digital asset sector through its stake in Nu Holdings (NYSE: NU)

Notably, Berkshire Hathaway holds 107 million shares in Nu Holdings, which has seen impressive gains this year. Buffett purchased his stake in the company for almost $750 million in 2021, around its initial public offering (IPO) phase.

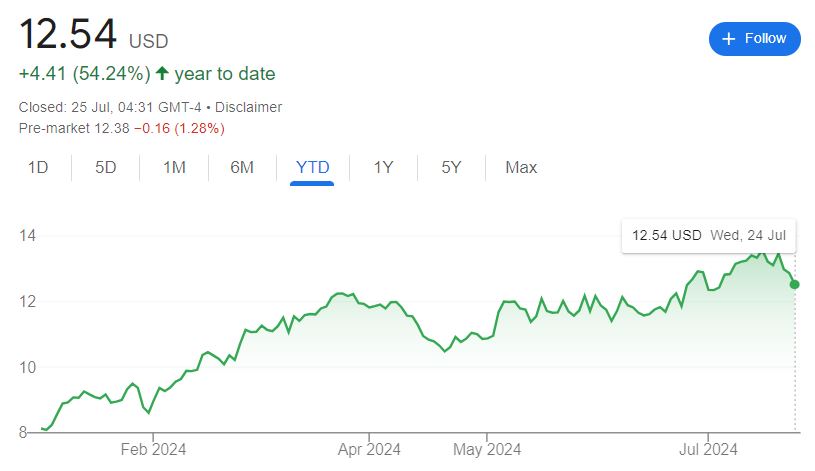

NU YTD stock price chart. Source: Google

Warren Buffett’s returns from NU

To put this into perspective, at the beginning of 2024, Berkshire Hathaway’s 107 million shares in Nu Holdings were worth about $871.98 million. With the stock’s rise to $12.54 per share, these shares are now valued at approximately $1.343 billion. This represents a gain of around $471.8 million in 2024 alone.

Indeed, this investment highlights Buffett’s strategic investment strategy, emphasizing his ability to recognize and capitalize on lucrative opportunities, even in sectors he has historically been skeptical about.

Despite Buffett’s well-known aversion to Bitcoin, Nubank has embraced cryptocurrency by offering different services, such as allowing customers to withdraw Bitcoin, Ethereum (ETH), and Solana (SOL) directly from their Nubank Wallet.

The bank’s ability to integrate cryptocurrency transactions has placed it at the forefront of digital banking in Latin America, attracting a growing user base and increasing its stock value.

It’s worth noting that Berkshire Hathaway has historically shown an inclination toward banking and insurance company stocks.

However, as reported by Finbold, the conglomerate sold 33.9 million shares of Bank of America (NYSE: BAC) for nearly $1.5 billion at an average price of $43.56 per share in a rare transaction. Despite the sale, Bank of America remains Berkshire Hathaway’s second-largest holding.

Disclaimer:The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.