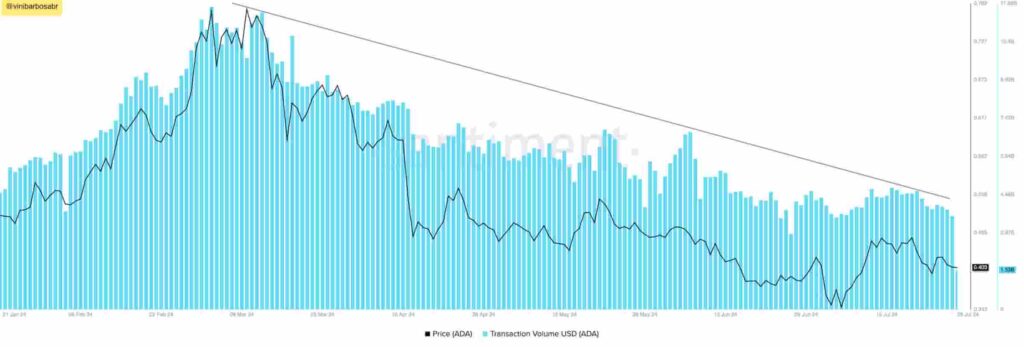

In 2024, Cardano (ADA) lost some market cap positions to growing competitors following poor price performance and increasing network apathy. Evidencing that, onchain data shows a decreasing transaction volume for Cardano as the network usage slows down.

This news could suggest the network’s native token, ADA, is overvalued. However, even the down-trending transaction volume is proportionally higher than Ethereum’s (ETH).

Cardano (ADA) transaction volume (USD). Source: Santiment / Finbold (@vinibarbosabr)

Is Cardano (ADA) overvalued? Looking at NVT

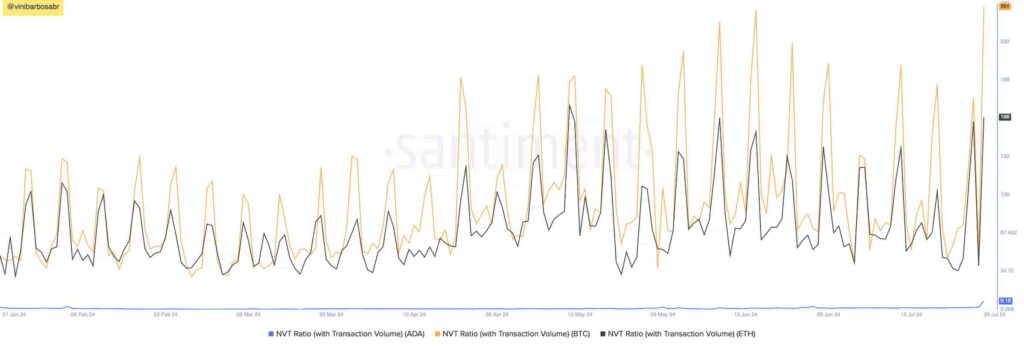

Nevertheless, being overvalued in the cryptocurrency market is also a matter of opportunity cost in comparison to competing cryptocurrencies. To understand if ADA is overvalued based on its transaction volume, fundamental analysts can use the Network Value-to-Transaction (NVT) indicator.

The NVT indicator divides a cryptocurrency’s market cap with its network’s transaction volume or circulating tokens, creating a benchmark. For this metric, the higher the NVT, the more likely an asset is to be overvalued.

On that note, Cardano’s NVT ratio on July 30 was 9.16, according to Santiment‘s data retrieved by Finbold. This is a relatively low Network Value-to-Transaction ratio in the crypto space, presenting a counterpoint to the overvalued status.

Notably, Bitcoin (BTC) and Ethereum currently have a 251 and 166 NVT ratio each, respectively. These ratios are 27 and 18 times higher than the ADA’s indicator, suggesting that Cardano’s market cap is far more balanced with its network’s transaction volume than the two leaders.

Network Value-to-Transaction (NVT): ADA, BTC, ETH. Source: Santiment / Finbold (@vinibarbosabr)

Cardano DeFi status: ADA TVL suggests an overvalued ecosystem

On the other hand, NVT is not the only fundamental analysis metric to consider, and investors should consider other indicators. For example, Cardano has one of the highest MCap/TVL ratios among other decentralized finance (DeFi) chains.

This metric, similar to the NVT, divides the project’s capitalization by the Total Value Locked (TVL) in its ecosystem’s protocols.

Cardano ranks 28th by TVL with $229.16 million despite ranking 10th by market cap with $14.35 billion. Therefore, this results in a 62.63 MCap/TVL, far higher than Near’s (NEAR) 22.78 or Ethereum’s 6.76.

Cardano (ADA) ranks 28th by Total Value Locked (TVL). Source: DefiLlama / Finbold

Overall, Cardano has seen a decreasing transaction volume and investors’ interest in its DeFi ecosystem. Both metrics suggest Cardano could be overvalued, although the former is proportionally higher than Bitcoin’s and Ethereum’s when weighted by market cap.

ADA traders and investors must consider different metrics and indicators and make comparisons to determine whether Cardano is overvalued in the current market conditions.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.