Solana (SOL) recently faced a steep decline of over 7% in the past 24 hours, driven by a shift in market sentiment following the release of the Nonfarm Payroll (NFP) report on August 2.

Despite this decline, Solana has demonstrated robust performance in the decentralized finance (DeFi) sector. According to DeFiLlama, Solana outpaced Ethereum (ETH) in overall trading volume for July, leading daily trading on 17 days.

Solana’s DeFi protocols accounted for 30% of all crypto decentralized exchange (DEX) volume in July, processing $56.849 billion in transactions, compared to Ethereum’s 28.12% share and $53.867 billion.

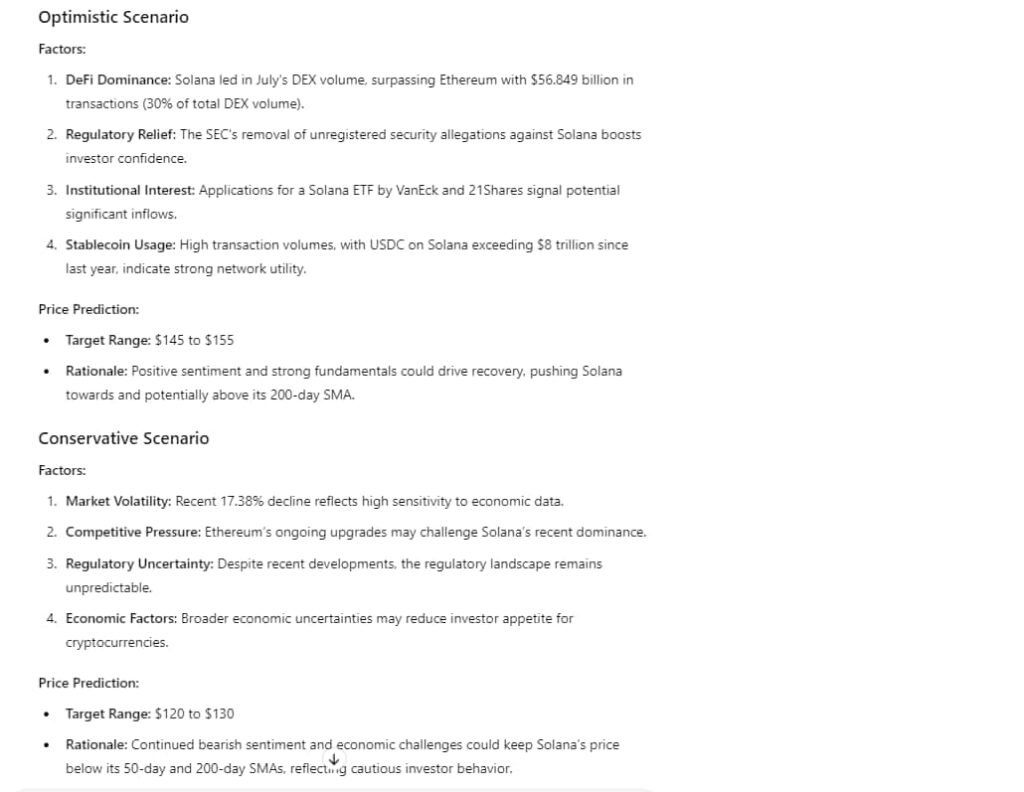

ChatGPT-4 investment outlook on Solana. Source: ChatGPT-4o / Finbold

These factors, combined with strong community and developer support, suggest a recovery and growth toward its 200-day simple moving average (SMA).

In a more conservative scenario, Solana might range between $120 to $130 by August 31, 2024. This cautious outlook considers recent market volatility, competitive pressure from Ethereum, ongoing regulatory uncertainties, and broader economic challenges.

The current price being below both the 50-day and 200-day SMAs indicates potential continued downward pressure, reflecting cautious investor sentiment.

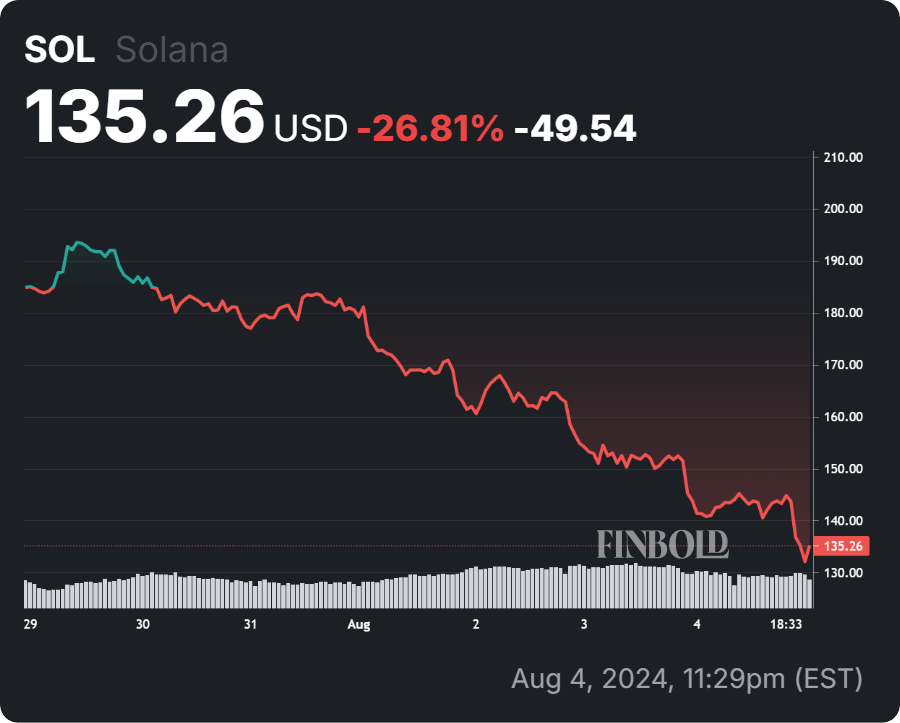

SOL price analysis

At press time, Solana was trading at $135.52, with losses of over 6.35% in the last 24 hours. On the weekly chart, SOL is down over 27%.

Solana seven-day price chart. Source. Finbold

Overall, Solana’s price trajectory by August 31, 2024, will be influenced by its strong DeFi performance, regulatory developments, and broader market conditions. The optimistic scenario suggests a potential recovery and growth, while the conservative outlook highlights the risks of continued market fears and economic uncertainties.

Investors should closely monitor these factors and market indicators to make informed decisions.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.