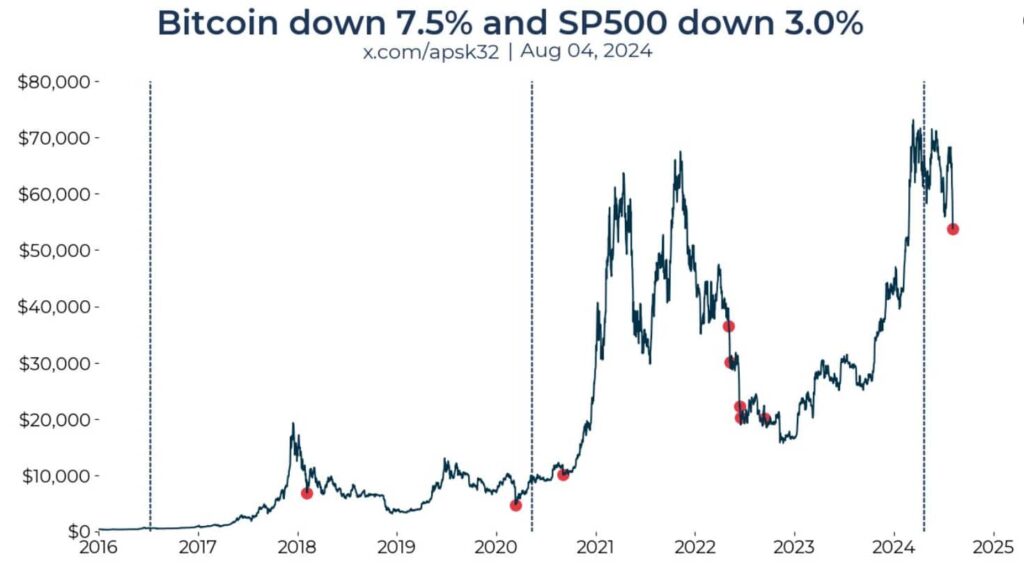

On August 4, 2024, both Bitcoin (BTC) and the S&P 500 experienced a significant drop, with Bitcoin falling by 7.5% and the S&P 500 by 3%.

This comes amidst mounting recession fears and notable market volatility. On August 2, $2.9 trillion vanished from the stock markets, marking the worst day of trading since the COVID-19 crash in 2020.

The crypto markets were also heavily impacted, with Bitcoin dropping by 18%, Ethereum (ETH) by 27%, and more than $381.26 million in futures positions liquidated in 24 hours.

Bitcoin and S&P 500 comparison over the past eight years. Source: apsk32/X

On March 12, 2020, and September 3, 2020, these dates coincided with the period around the Bitcoin halving event, known for its market volatility and subsequent price increases.

Investors who capitalized on these dips saw six-month returns of 109.8% and 375.7%, respectively. On February 5, 2018, a decline occurred during a temporary recovery phase within the halving cycle.

The market saw a seven-day return of 28.3%, a one-month return of 42.7%, but only a modest six-month return of 1.1%.

On May 5 and 9, June 13 and 16, and September 13, 2022, these declines happened during the 2022 bear market, characterized by prolonged downturns.

The six-month returns were significantly negative, with May 5 and 9, 2022, showing -43.9% and -29.4%, respectively.

Analysis and recommendations

Given the historical data, the current simultaneous drop in Bitcoin and the S&P 500 may present potential buying opportunities, albeit with caution.

The historical patterns suggest varied outcomes based on the market context. If the market follows the pattern observed around the 2020 halving, significant short-term gains could be on the horizon, as evidenced by historical seven-day and one-month returns.

Conversely, if the market mirrors the 2022 bear market pattern, investors might face prolonged downturns with significant negative returns over a six-month period.

Diversifying investments and establishing clear exit strategies can help mitigate risks and enhance potential returns. While past events around Bitcoin halvings have led to significant returns, prolonged bear markets have also resulted in considerable losses.

Investors should carefully analyze the current market conditions and historical patterns to make informed decisions, balancing the potential for short-term gains with long-term uncertainties.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.