Considering the lucrative opportunities offered by the cryptocurrency trading environment, it comes as no surprise that carefully timed trades can bring a lot of profit to a wise investor, as evident in the recent example of a crypto trader making a whopping $15 million.

As it happens, this particular investor has recently sold 540 Wrapped Bitcoin (WBTC) at the price of $54,853 in the past two days, making approximately $15.5 million on the sale, according to the data shared by the blockchain analytics platform Lookonchain in an X post on August 7.

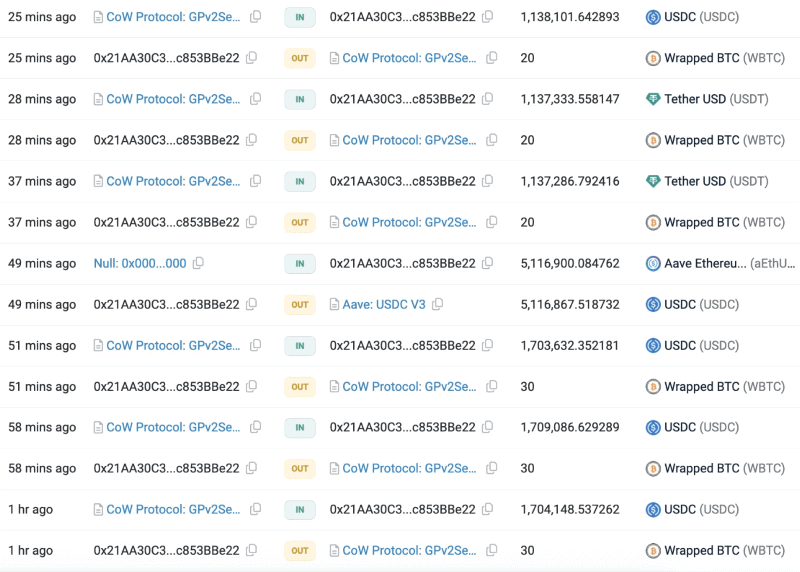

Whale’s recent transactions. Source: Lookonchain

Indeed, during the initial purchase, this crypto trader bought 721 WBTC at the price of $26,191 per WBTC, or around $18.88 million, between August 21 and August 25, 2023. Nearly one year later, the whale sold 540 WBTC for a $15.5 million profit, effectively turning $18.88 million into $29.6 million.

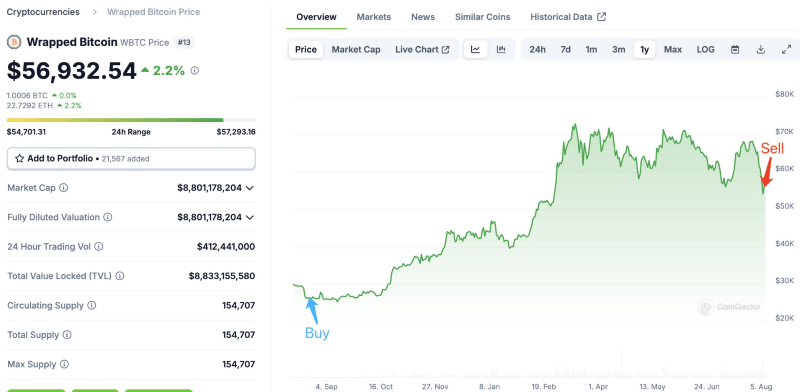

WBTC price change between purchase and sale. Source: Lookonchain

On top of that, this whale still has 181 WBTC left in his crypto wallet, worth over $10 million according to the current prices, which they could wait to sell for a higher price (which many analysts consider would happen for a fact) and, as a result, bring in an even higher profit.

WBTC price analysis

As a reminder, Wrapped Bitcoin refers to the alternative version of Bitcoin (BTC), enabling its value to carry over to another blockchain through the concept introduced as a solution for the blockchain interoperability challenge. In the WBTC’s case, it tracks the value of Bitcoin with a 1:1 ratio.

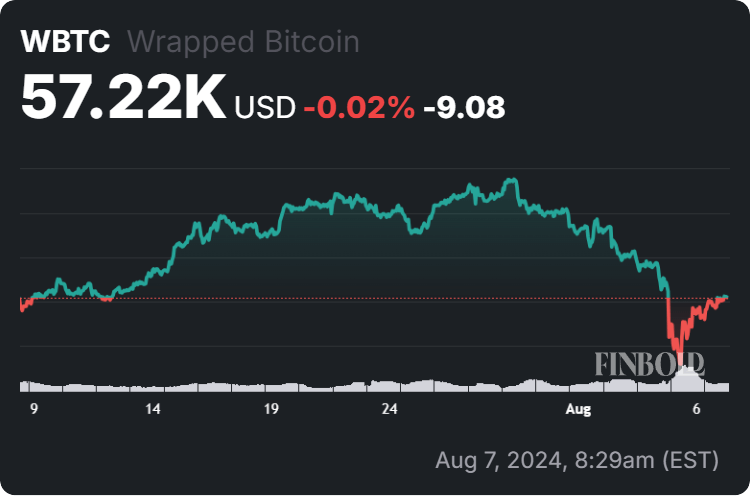

At press time, WBTC continues to match the price of Bitcoin, changing hands at $57,220, which represents a 4.72% recovery in the last 24 hours, albeit accumulating a decline of 14.09% across the previous seven days, and recording a minor 0.02% drop on its monthly chart.

WBTC price 30-day chart. Source: Finbold

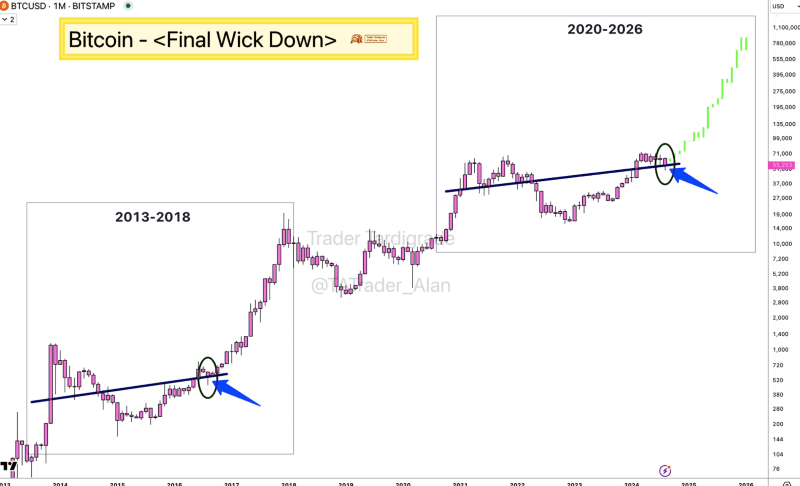

All things considered, this trader has managed to make a significant profit from their carefully timed trades, although historical indicators suggest they could have waited for the “super bull rally” of the largest asset in the crypto market, as well as its wrapped version, for even more substantial earnings.

Bitcoin price performance analysis in context of super cycle theory. Source: Trader Tardigrade

That said, doing one’s own due diligence, weighing all the risks, carefully researching the token and all its relevant data, as well as any relatable news, is critical when investing, especially in the crypto sector, where trends can change on a whim.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.