BlackRock (NYSE: BLK) has actively accumulated Bitcoin (BTC), especially for the exchange-traded fund (ETF) managed by its subsidiary, iShares (IBIT). Yet, investors wonder if BlackRock is selling its BTC in the face of the recent crash that suddenly shifted the cryptocurrency market‘s sentiment.

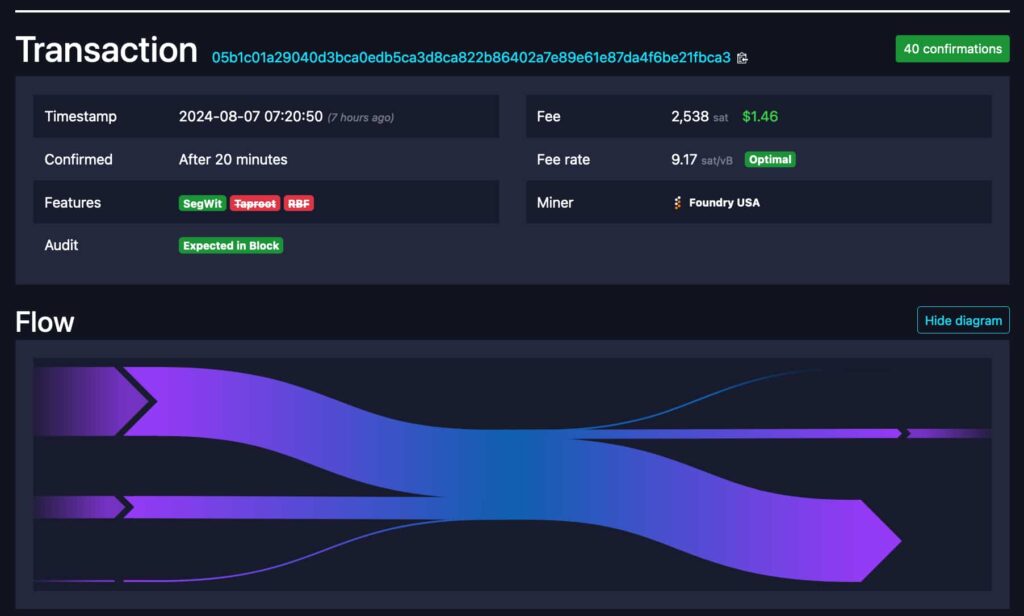

According to the on-chain analyst known as Maartun, BlackRock could indeed be selling Bitcoin today, on August 7. As reported, monitored BlackRock wallets moved 632 BTC to a recently created wallet. However, the analyst explained that he is unsure whether this is a selling activity on Coinbase or an internal transaction.

Transaction 05b1c01a29040d3bca0edb5ca3d8ca822b86402a7e89e61e87da4f6be21fbca3. Source: mempool.space

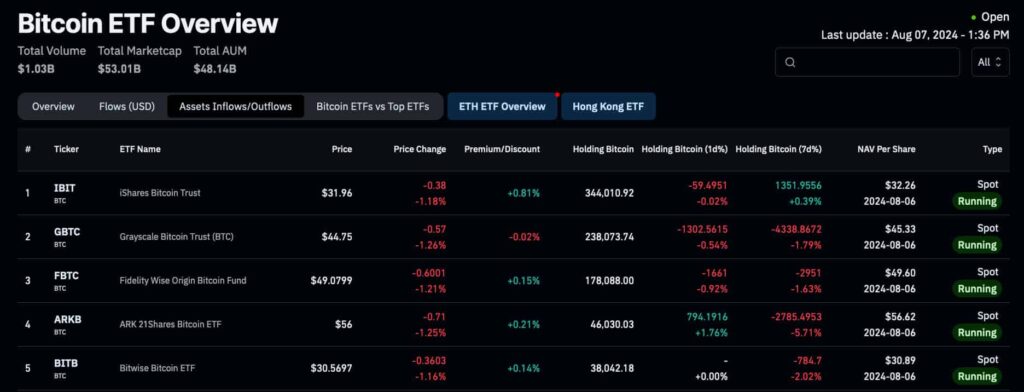

Bitcoin ETF Overview, Assets Inflows/Outflows. Source: CoinGlass / Finbold

BlackRock’s Bitcoin inflow and outflow (buying and selling)

Alistair Milne, CIO at Altana Digital, reported only one day of outflows to the iShares Bitcoin trust. The executive explained that “someone” could have been “taking the risk of keeping the shares” IBIT investors sold.

Want to see something cool?IBIT, Blackrock's Bitcoin ETF has only ever recorded one day of outflowsSomeone appears to be taking the risk of keeping the shares people are selling and not redeeming them for cash, allowing IBIT to register many '0' days of flows pic.twitter.com/nLw2YipGJV

— Alistair Milne (@alistairmilne) August 6, 2024Data from CoinGlass indeed show BlackRock so far registering zero flows from its Bitcoin ETF in the past two days. This same behavior was observed in previous BTC dips when most ETFs were selling.

Total Bitcoin Spot ETF Net Inflow (USD). Source: CoinGlass / Finbold

Now, the market awaits today’s flow disclosure to see if BlackRock is selling part of its Bitcoin holdings. Finbold recently reported Robert Mitchnick, Head of Digital Assets for BlackRock, revealing Bitcoin and Ethereum (ETH) as the only two cryptocurrencies driving interest from the company’s clients.

Given the company’s size and influence, investors could see an outflow as a bearish signal moving forward. Conversely, iShares holding or buying BTC broadcasts a strong bullish signal that Bitcoin enthusiasts welcome during these uncertain times.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.