Amid some volatile times for the majority of assets in the cryptocurrency industry (and beyond), veteran trader and renowned markets expert Peter Brandt believes there is a “clear winner” in the battle between Solana (SOL) and Ethereum (ETH) and has shared his reasoning.

Specifically, despite protests coming from certain parts of the crypto community, Brandt is confident that Solana is the “clear winner” in the battle against Ethereum, arguing that the former is user-friendly and has a “great foundation,” according to his analysis shared in an X post on August 8.

On the other hand, he believes that Ethereum is “cumbersome, expensive, flawed, claims to be decentralized when its [sic] not,” asserting that the currently fifth-largest asset in the crypto sector by market capitalization “should gain 100% on ETH in the months ahead.”

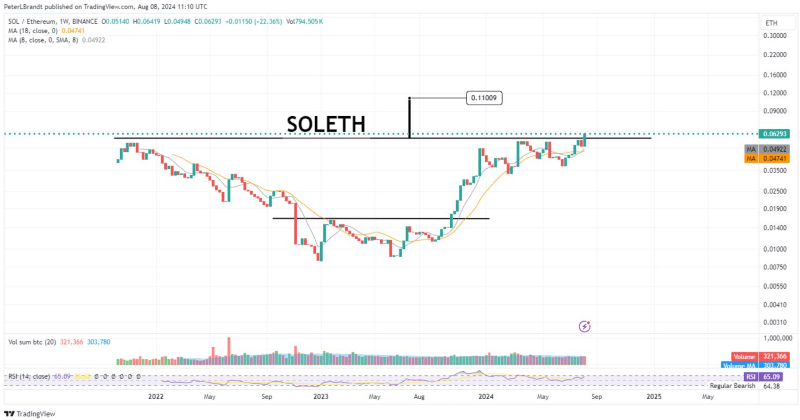

SOL/ETH performance analysis. Source: Peter Brandt

Indeed, Solana has been doing better than Ethereum this year in terms of price, having advanced 54.95% since January 1, 2024, whereas the most popular altcoin in the market managed to advance only 16.33% during the same time frame.

Brandt’s analysis sparks debate

Meanwhile, Brandt’s views have met resistance from certain members of the crypto industry, who disagreed in the comments, with one of the commenters opining that “SOL is FTX .. just waiting to happen,” and other arguing that:

“Ethereum is truly decentralised while Solana is one of the most centralised coin with many issues.”

Others have contended that Brandt, while understanding charts, does not understand tech, asserting that “SOL being user friendly and resting on a great foundation is the most disingenuous thing I’ve heard in a long time,” suggesting that the veteran trader might be “sucking up to the VC propaganda.”

Furthermore, crypto analyst Nilesh Rohilla drew a comparison between Solana and other assets once touted as ‘ETH killers,’ including EOS (EOS), which is today near its all-time low (ATL), and Cardano (ADA), which is 90% down from 2021 when it was “near 160x return,” and that the same will happen with SOL.

In response, Brandt accused Ethereum supporters of using the same arguments all the time “whenever I talk naughty about the item of their adoration,” comparing the ETH network to cars manufactured in the United States often in need of repair:

“I hear the same crap from ETH bulls whenever I talk naughty about the item of their adoration — ‘oh, but ETH is fixing this or that or this or that’!!!!!! Doesn’t it tell you something is wrong that ETH is always needing a fix??????? Kind of like U.S. built autos”

Solana price analysis

Elsewhere, in terms of its more recent price performance, Solana was at press time changing hands at the price of $155.58, up 0.68% on the day, down 4.87% across the past week, as well as accumulating an advance of 8.95% on its monthly chart, as per data on August 9.

Solana price 30-day chart. Source: Finbold

Ethereum price analysis

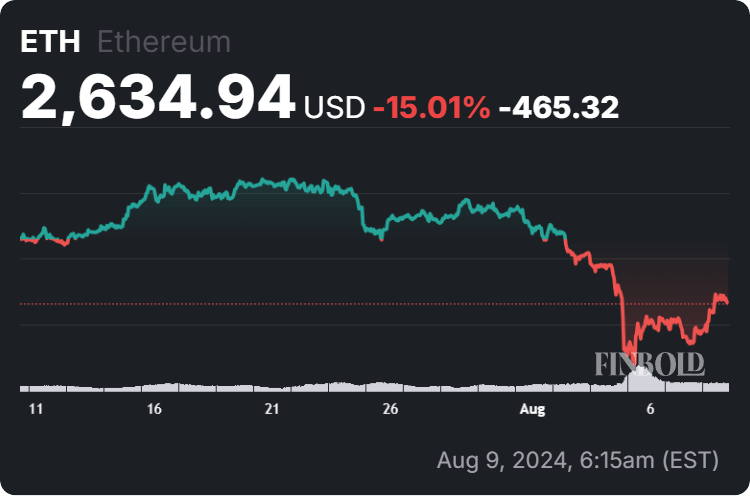

At the same time, the second-largest asset in the crypto sector by market cap was trading at $2,634.94, which indicates an increase of 7.42% in the last 24 hours, whereas in the previous seven days, it has declined 16.67%, adding up to the monthly loss of 15.01%.

Ethereum price 30-day chart. Source: Finbold

Overall, Brandt might, indeed, be correct in his observations, particularly amid a bearish momentum that has seen a rapid Ethereum sell-off triggered by institutional sales and fear dominating investor sentiment. On the other hand, Solana has often faced difficulties in its network operations.

That said, some crypto experts are heavily bullish on the future price of Solana, echoing Brandt’s sentiment, such as pseudonymous crypto trading analyst Jelle, who noted in late July that SOL might enter a “mania-like stage” and scale out aggressively, perhaps even to the price of $600.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.