Following a favorable ruling for Ripple, the parent company of XRP, in the Securities and Exchange Commission (SEC) case, there is anticipation that the development might spark a rally in the token’s valuation.

Notably, in the long-standing legal battle, a judge ordered Ripple to pay a $125 million civil penalty. However, there are signs that XRP will not be classified as a security following the ruling.

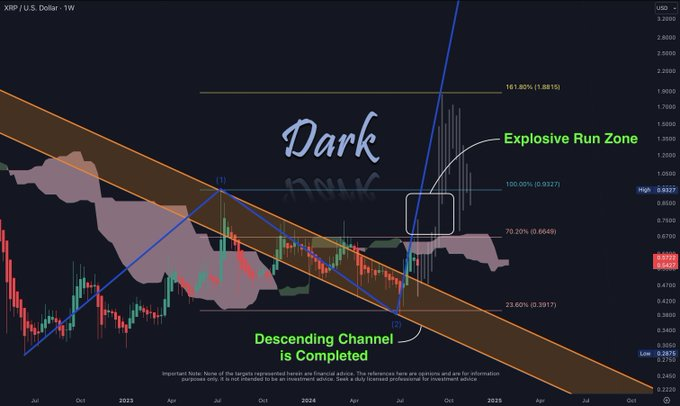

XRP price analysis chart. Source: Dark Defender

As traders watch the market, attention is particularly focused on the 100% Fibonacci retracement level at $0.9327, identified as a critical resistance point. If XRP successfully breaches this level, further bullish momentum could be sparked.

The expert also highlighted the “Explosive Run Zone,” where XRP could experience rapid price appreciation. Should XRP overcome the $0.9327 resistance, the next major target is the 161.80% Fibonacci extension level at approximately $1.88.

If reached, this area is expected to serve as psychological and technical resistance. On the downside, essential support levels are found at the 70.20% Fibonacci level of $0.6649 and the 23.60% level at $0.3917. These levels are crucial for traders to watch in the event of a pullback.

It’s worth mentioning that Dark Defender previously provided a roadmap for XRP’s rally from its current valuation to an all-time high of about $36.

As things stand, another target for XRP investors is the $1 resistance. Market commentators have maintained that breaching this level will likely end the token’s long-standing consolidation.

XRP price analysis

At press time, XRP had dropped by 6% in the last 24 hours, trading at $0.57. However, on the weekly chart, the token remains in the green zone, having rallied over 3%.

XRP seven-day price chart. Source: Finbold

In the meantime, amid the current correction, XRP investors will be hoping the general market sentiment influences the token to target new highs, with $0.65 as the next possible target.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.