James Fickel is the founder of the Amaranth Foundation, funding longevity research, and the world’s fifth richest known crypto investor. Fickle has partially closed a multi-millionaire long Ethereum (ETH) position against Bitcoin (BTC) on August 10 with wBTC-related news.

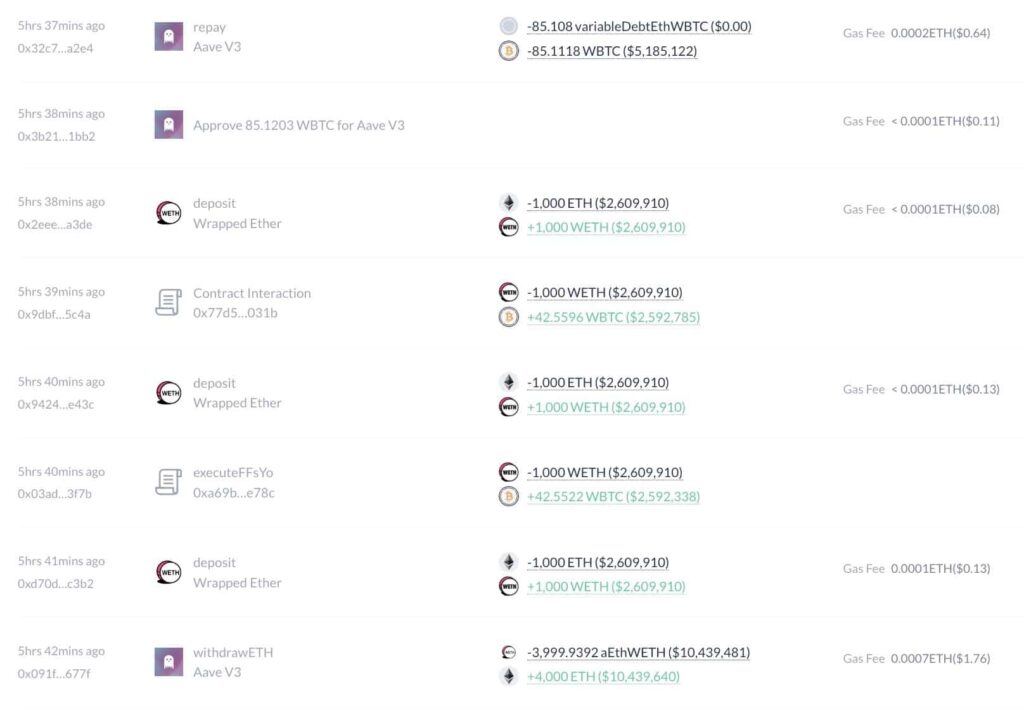

According to a Lookonchain report, the Amaranth Foundation’s founder started opening long positions on Ethereum against Bitcoin on January 10. These positions used an advanced decentralized finance (DeFi) strategy of lending, borrowing, and trading one asset against the other.

Essentially, James Fickel provided lending liquidity on Aave (AAVE) to use as collateral to borrow 3,061 Wrapped Bitcoin (wBTC). He then used this $172 million wBTC loan to swap for 56,445 ETH in these seven months since January. Lookonchain calculates an average ETH/BTC exchange rate of 0.05424.

James Fickel (0xd85351181b3F264ee0FDFa94518464d7c3DefaDa) activity. Source: Lookonchain

Who is James Fickel? Crypto investor and longevity researcher

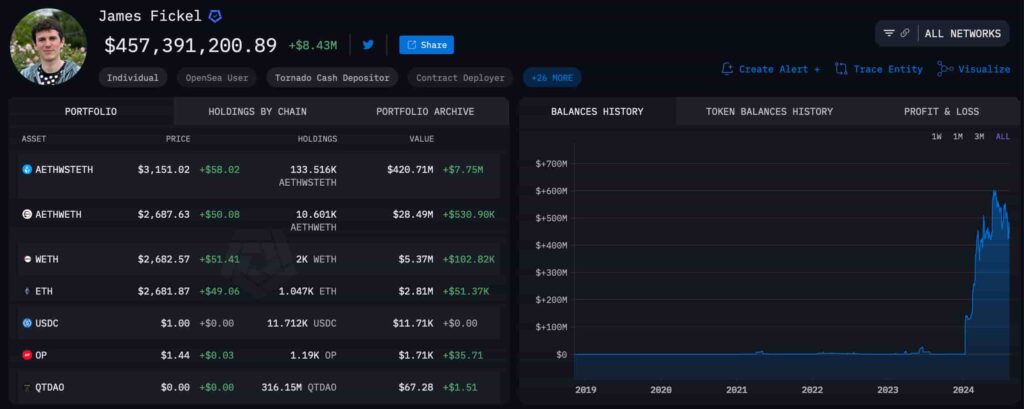

According to Arkham’s research from April 2024, James Fickel was the world’s fifth-richest cryptocurrency investor, worth over $446 million. Notably, Finbold retrieved data from Arkham Intelligence on August 11 showing the investor’s crypto net worth already increased by $10 million since then, at $457.39 million

The majority of his portfolio consists of 133,516 AETHWSTETH ($420 million) and 10,601 AETHWETH ($28.49 million). We can also see wETH, ETH, USDC, Optimism (OP), and other cryptocurrencies representing smaller shares of Fickel’s holdings.

James Fickel crypto investment portfolio and net worth. Source: Arkham Intelligence

Besides being an active cryptocurrency investor and Ethereum enthusiast, James Fickel is the founder of the Amaranth Foundation. Interestingly, his foundation conducts and funds leading research on longevity and neuroscience, studying aging solutions.

As seen in his trades, James Fickel has shown a strong investment conviction that ETH will overperform BTC in 2024. Nevertheless, given the most recent trading activity, the market now wonders if this conviction remains as strong as before.

From another perspective, Fickel recently commented on the recent partnership between BitGo and Justin Sun related to wBTC operations. Thus, it is possible that the observed repayment is part of a risk management strategy for a perceived increased wBTC risk instead of a weakened conviction on Ethereum.

The fact that this clown is still tap dancing around the world causing damage 6 years after launching his multibillion dollar scamchain with a plagiarized white paper is further evidence of how badly you do your job @SECGov @GaryGensler https://t.co/Ke5FRqwtb1

— James Fickel ? (@jamesfickel) August 10, 2024The cryptocurrency market is highly volatile and yet mostly experimental, requiring constant risk evaluation and decision-making.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk