Bitcoin (BTC) is once again attempting to reclaim the $60,000 psychological level after a recent dip triggered a broader selloff in the cryptocurrency market.

This recovery comes as traders and investors brace for a busy week, with key economic data releases and geopolitical factors expected to heavily influence market sentiment.

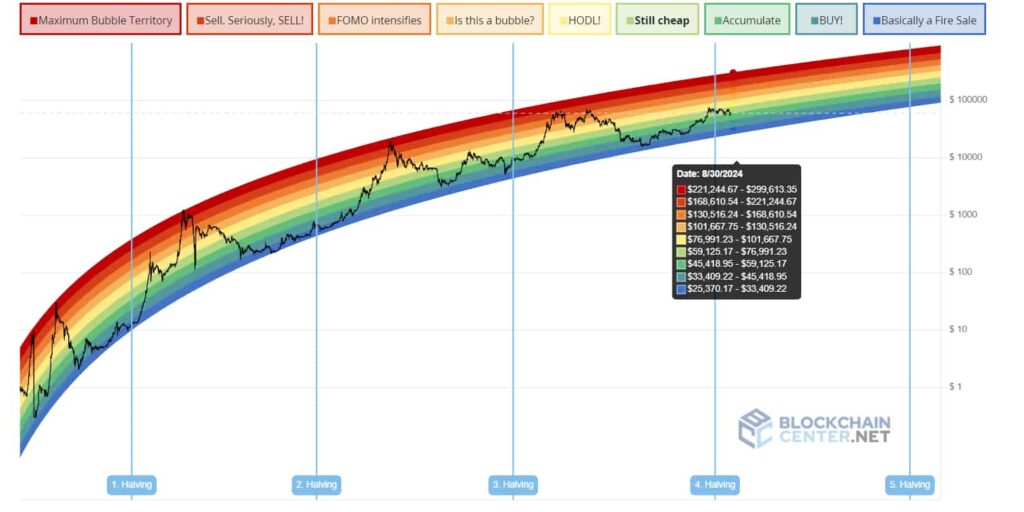

The focus remains on Bitcoin’s price movements, with the Bitcoin Rainbow Chart offering crucial forecasts for BTC’s trajectory by the end of August 2024.

Bitcoin Rainbow chart. Source: BlockhainCenter

This chart, well-regarded for its ability to highlight long-term trends, helps traders and investors assess market conditions and make informed decisions.

Currently, Bitcoin is placed just within the “Accumulate” zone ($45,418.95 to $59,125.17). This zone suggests that while Bitcoin is no longer at its lowest point, it still presents a favorable opportunity for investors looking to add to their positions, with expectations of further price increases.

If Bitcoin rises above $59,125.17, it would move into the “Still Cheap” zone ($59,125.17 to $76,991.23). This would indicate that while the price is climbing, it remains within a range that offers value, allowing for continued accumulation before potentially reaching higher valuations.

Should Bitcoin advance further into the “HODL!” zone ($76,991.23 to $101,667.75), it would signal a strengthening market sentiment, where holding onto existing positions becomes increasingly favorable as the price may continue to appreciate.

In summary, the Bitcoin Rainbow Chart suggests that by the end of August 2024, BTC could either remain within the “Accumulate” or “Still Cheap” zones, presenting ongoing opportunities for accumulation, or it could climb into higher zones, signaling stronger market sentiment but also increasing caution for potential overvaluation.

As Bitcoin’s price nears the $60,000 psychological level, these zones provide a clear roadmap for navigating the market’s next moves.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.