On August 14, the United States will release the monthly Consumer Price Index (CPI) data, a leading economic indicator. U.S. CPI news may influence all finance markets worldwide, including cryptocurrencies, stocks, forex, and commodities – driving Finbold to seek insights on an Ethereum (ETH) price prediction.

Ethereum is the second-largest cryptocurrency by market capitalization behind Bitcoin (BTC) and the most valuable blockchain infrastructure ecosystem. Recently, the project has gained the spotlight with traditional finance participants like BlackRock (NYSE: BLK) through the ETH spot ETFs.

Therefore, as the leading Web3 and decentralized finance (DeFi) token grows in relevancy on Wall Street, macroeconomic data releases like the CPI could have a larger impact on its short-term price speculation.

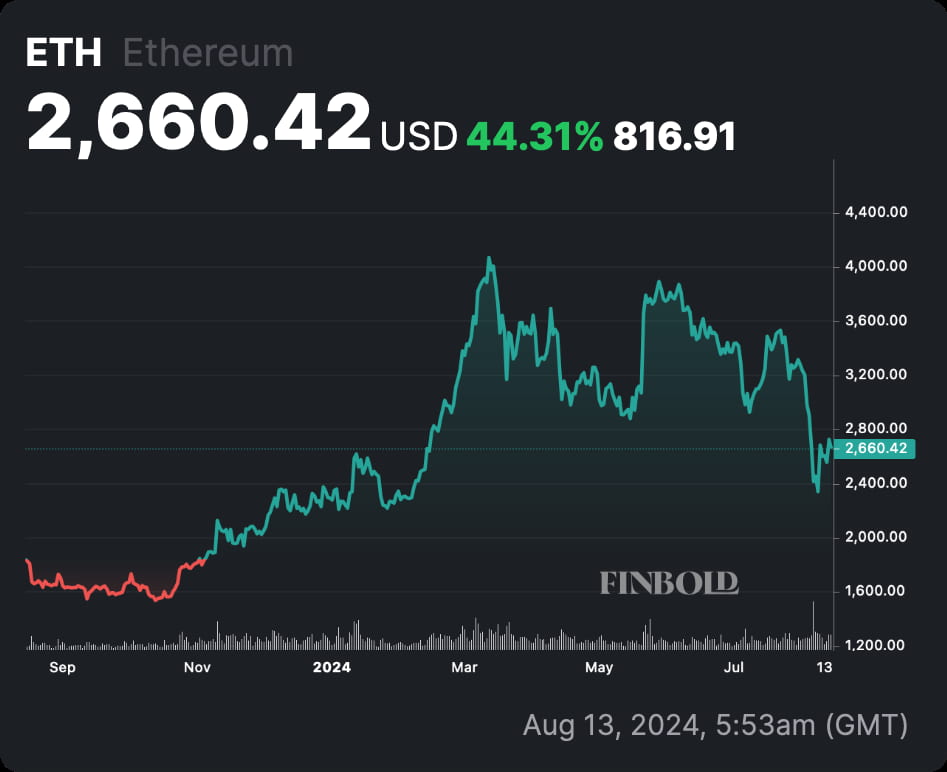

Ethereum (ETH) price prediction. Source: Finbold

AI’s Ethereum price prediction in the CPI news context

In a mid-term prediction, Finbold recently reported Ethereum could trade between $6,500 and $8,000 in 2025. Meta AI’s Llama 3.1 gave the forecast considering increased institutional interest and ecosystem growth.

Looking at a short-term analysis, we asked ChatGPT-4o, Claude 3.5 Sonnet, and Llama 3.1. In particular, we provided last month’s CPI data and this month’s expectations, with ETH’s current price.

All three artificial intelligence (AI) models considered three scenarios for their Ethereum prediction. First, CPI data that meet the market expectation at 3.0% and 3.2% for the Core CPI is likely already priced in – expecting a 1% to 3% price increase up to $2,750. Interestingly, last month’s Consumer Price Index came as 3.0% and 3.3% in the Core indicator.

Core CPI and CPI data. Source: Investing

A bullish case is made if the CPI comes below expectations, which could drive ETH to trade between $2,700 and $3,000, according to consolidated predictions from the three models. However, a higher-than-expected CPI could potentially nuke Ethereum’s price below $2,500.

Overall, the Federal Reserve has been using CPI data as one of the leading indicators in deciding on interest rates. Reducing price inflation could encourage the Federal Open Market Committee (FOMC) to finally start cutting rates.

The high interest rate financial landscape has increased recession fears and drained capital from risk assets like Ethereum. In this context, cryptocurrency traders and investors can start pricing an interest rate cut under favorable CPI news.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.