Ethereum (ETH) has captured the attention of investors this month with its sharp price movements. As of August 16, Ethereum is trading around $2,576, following a significant rally earlier in the month.

This upward momentum saw Ethereum climb from $2,200 to $2,770, marking a remarkable 31% increase in just ten days. However, the road ahead for Ethereum is fraught with both bullish opportunities and bearish risks, making its price outlook for the end of the month particularly intriguing.

In this context, Finbold has leveraged ChatGPT-4, OpenAI’s most recent and advanced AI chatbot model, to offer insights into how Ethereum is likely to trade by August 31, considering the key factors influencing its future price trajectory.

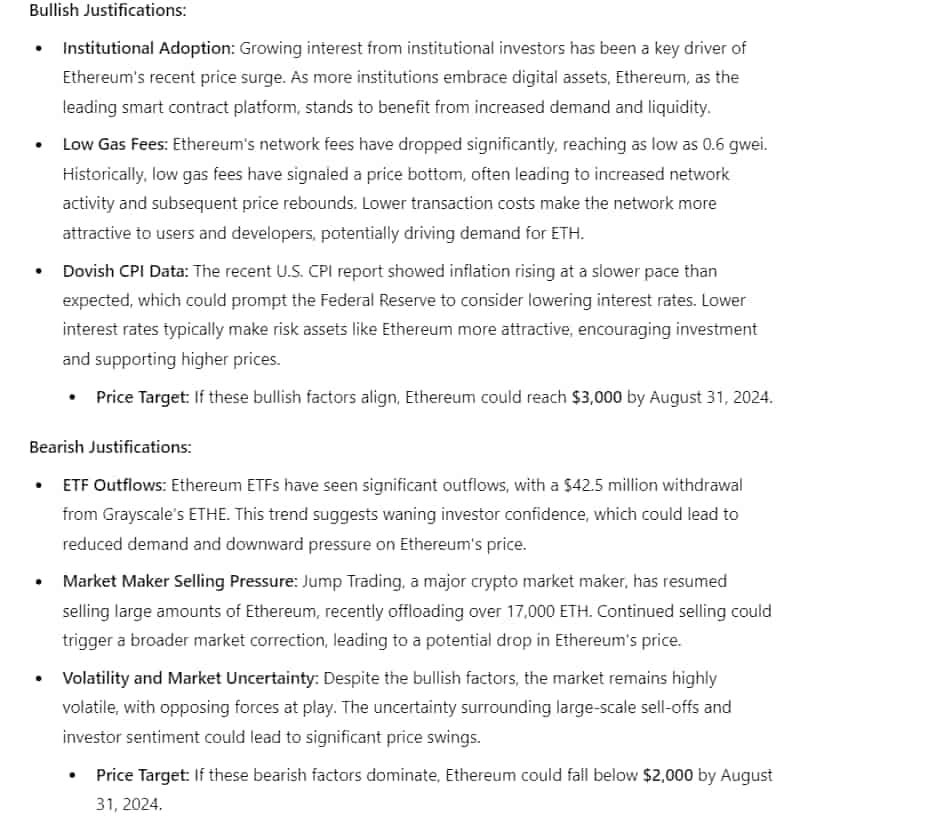

ChatGPT-4o ETH price prediction. Source: ChatGPT/Finbold

Conversely, a bearish scenario might see ETH fall below $2,000 due to ETF outflows, market maker selling pressure, and overall market uncertainty.

In conclusion, Ethereum’s price outlook for the end of August 2024 is shaped by a mix of bullish and bearish factors.

While the potential for further gains exists, driven by institutional adoption, low gas fees, and favorable economic conditions, significant risks remain, particularly from ETF outflows and large-scale selling by key market players. Investors should be prepared for a volatile ride as Ethereum navigates these complex market dynamics, with a potential upside of $3,000 or a downside risk below $2,000 by August 31.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.