The cryptocurrency market has been marked by significant volatility, with Bitcoin (BTC) making gains on August 17, crossing the $59,000 mark after a turbulent week of trading.

This upward movement is driven by speculation around a potential rate cut by the US Federal Reserve in their upcoming meeting. However, investor caution remains, as many are waiting for clearer signals before making decisive moves.

Amid this backdrop, several altcoins are on the cusp of major milestones, with some approaching the $100 billion market cap threshold, positioning themselves for potential rallies in the near future.

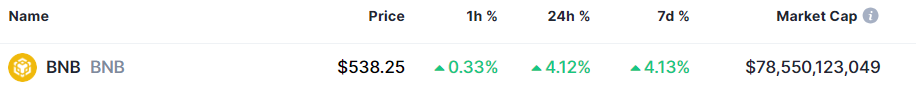

BNB market cap. Source: CoinMarketCap

Furthermore, the Total Value Locked (TVL) on Binance Smart Chain (BSC) rose significantly from $3.6 billion to $4.27 billion between August 5 and August 17, indicating growing confidence in Binance’s ecosystem.

This increase in TVL suggests that investors are increasingly committing capital to the platform, reinforcing BNB’s role as a key asset within the Binance ecosystem.

In addition to these fundamental developments, derivatives data from Coinglass signals a bullish sentiment among traders. The increase in open interest reflects growing trader engagement, often a precursor to significant price movements.

Moreover, the long/short ratios across major exchanges, all exceeding 1.0, indicate that the majority of traders are positioning for a price increase, further solidifying the bullish outlook.

Additionally, the rise in options open interest by 8.15% highlights the growing confidence in BNB’s upward potential as traders position themselves for further gains.

These factors, combined with the current market momentum and the positive sentiment around Binance’s strategic moves, create a strong foundation for BNB to achieve significant gains and potentially reach a $100 billion market cap by September.

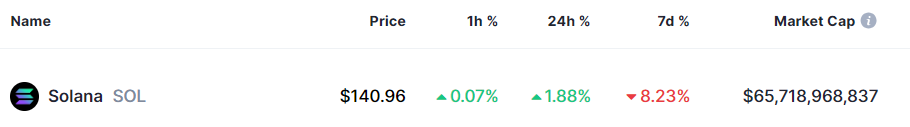

Solana (SOL)

Solana is rapidly approaching the $100 billion market cap milestone, fueled by key developments and a surge in network activity.

Following the approval of spot Solana ETFs in Brazil on August 8, 2024, the cryptocurrency experienced a notable rally, boosting its market cap to $65.77 billion.

Solana market cap. Source: CoinMarketCap

This regulatory green light has opened the floodgates for institutional investment, adding significant momentum to Solana’s growth trajectory. Conversely, Solana ETF filings in the United States were withdrawn by the issuers, as reported by Finbold.

At the same time, the number of active addresses soared to a record 54.33 million in July, reflecting a staggering 151% growth since the start of the year.

This surge is largely driven by the memecoin mania, which has turned Solana into a hub for new token launches. July also saw non-vote transactions peak at 1.3 billion, underscoring the platform’s growing utility.

While some of this activity may be driven by speculation, the overall expansion indicates that Solana is strengthening its position in the crypto market. If the current momentum holds, Solana is well-positioned to hit the $100 billion mark by September.

With strategic developments and increasing market confidence, these two cryptocurrencies are well on their way to achieving significant milestones in the coming weeks.

Investors should keep a close eye on these assets as they navigate through the volatility and capitalize on the potential gains ahead.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk