After a week of intense volatility, Bitcoin (BTC) has surged past the $59,000 mark, driven largely by speculation surrounding a potential rate cut by the US Federal Reserve.

However, despite this upward momentum, the cryptocurrency market remains in flux, with sentiments swinging between fears of a new bear market and hopes of skyrocketing prices.

Amidst this uncertainty, an analyst known by the pseudonym Stockmoney Lizards suggests that Bitcoin’s next big move might surprise many.

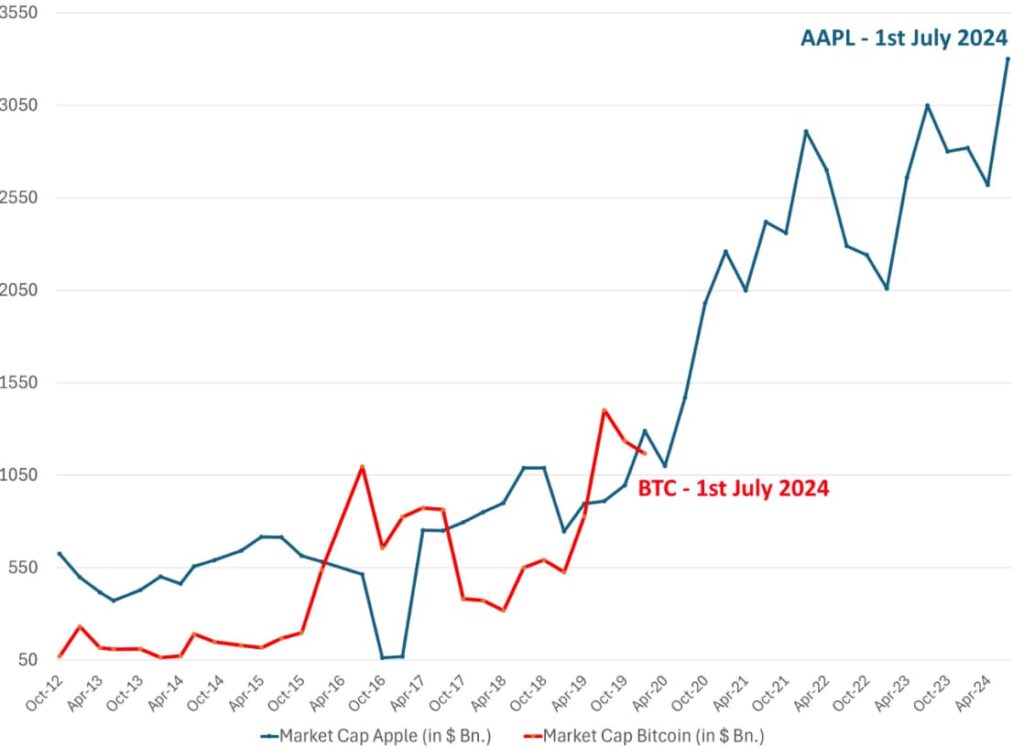

Market cap comparison – BTC and AAPL. Source: Stockmoney Lizards / X

A comparison of Bitcoin’s market cap to Apple’s (NASDAQ: AAPL) as of July 1, 2024, supports this evolution.

While Apple’s market cap has demonstrated consistent and substantial growth, Bitcoin’s market cap has exhibited more erratic behavior, marked by sharp peaks and troughs.

Presently, Bitcoin’s market cap stands at approximately $1.18 trillion, significantly lower than Apple’s. Given these current market conditions, it seems increasingly unrealistic to expect Bitcoin to replicate its past exponential growth.

Instead, a more measured growth of 150% to 200% over the next two years seems plausible, potentially driving Bitcoin’s price to the $150,000 to $200,000 range.

Flattening cycle top: Stability over speculation

As Bitcoin gains traction among institutional investors and is increasingly regarded as “digital gold,” its price dynamics are beginning to mirror those of traditional finance assets.

This shift is evident in historical charts, where Bitcoin’s once parabolic rises are now giving way to a more stable, albeit still volatile, growth pattern.

With Bitcoin now deeply integrated into traditional finance portfolios, future market corrections are likely to be less severe, resembling the 20% to 30% downturns typically seen in S&P 500 bear markets.

Consequently, the parabolic phase of Bitcoin’s growth is expected to flatten, leading to more consistent price increases over time.

Steady growth: The surprising shift

While Bitcoin may no longer deliver the extreme gains of its early years, the future still holds significant potential for steady, sustainable growth, according to the analyst.

The current trends suggest that Bitcoin’s market cap could continue to rise, potentially reaching $5 trillion, $10 trillion, or even $15 trillion in the long term.

This steady growth is supported by Bitcoin’s unique attributes, including its fixed supply and resistance to inflation, which make it an increasingly attractive store of value.

Bitcoin seven-day price chart. Source: Finbold

In conclusion, Bitcoin has recently risen to $59,982, marking a 1.5% gain in the last 24 hours, yet it has also experienced a 1.7% decline over the past week, supporting the ongoing volatility in the market.

Looking ahead, Bitcoin’s next significant move is likely to involve a shift toward more steady and sustainable growth rather than the dramatic spikes of the past.

As Bitcoin continues to mature, its price movements are expected to become more predictable, solidifying its role as a cornerstone in investment portfolios and offering long-term stability and appreciation.

For investors, employing a dollar-cost averaging (DCA) strategy may be the most effective approach to harness Bitcoin’s potential, allowing them to navigate short-term fluctuations while positioning themselves for long-term gains.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk